Relationship Commerce

Your quick guide to subscriber churn: what it is and how to reduce it

Some subscriber churn is inevitable and even good.

New parents will cancel their diaper subscription when their child gets older. But if they leave on good terms, they might re-subscribe if they have another child or recommend your brand to friends with a baby on the way.

Then there’s the churn you can and should try to prevent. McKinsey reports that a lack of “good value for price” drives 43% of subscription cancellations. You can fight this churn by increasing incentives the longer a subscriber sticks with you.

If you don’t understand the key reasons subscribers churn and actively try to engage them, you’re missing opportunities to grow your subscription business and deepen customer relationships.

What is subscriber churn?

Subscriber churn is a measure of the number of subscribers who cancel their subscriptions in a given period. There are two types of churn.

Voluntary churn

Subscribers churn voluntarily when they make a conscious decision to cancel. They no longer see enough value in a company’s products or services or enough convenience in the subscription experience.

McKinsey reports that 26% of subscribers churn either from a lack of “flexibility” or a lack of “convenient or easy access.”

Involuntary churn

Involuntary churn occurs when you drop otherwise satisfied subscribers due to a failed recurring payment.

Payments fail when a customer’s credit or debit card expires or when the bank rejects their payment because of a network error or exceeded credit limit. According to PYMNTS research, payment declines prompt as many as 27% of subscribers to churn.

Subscribers often have no idea they’ve churned involuntarily, leading to dissatisfaction when an anticipated shipment doesn’t arrive.

How subscriber churn impacts your business

Rising subscriber churn rates eat into the recurring revenue that makes subscription experiences so attractive to businesses. Less reliable cash flow has ripple effects across your organization.

Smaller returns on customer acquisition cost (CAC)

With CAC rising across the board, high rates of subscriber churn can quickly slow business growth.

As companies lose access to browser-cookie information and first-party consumer data, they increasingly turn to social and search to acquire customers. According to Ordergroove Chief Revenue Officer Ralph Robertson, this transition means that “merchants and businesses are having to spend 5x to generate the same amount of traffic.”

Because of the recurring revenue they generate, subscribers eventually pay the cost of their acquisition. The longer they subscribe, the higher they drive CAC returns by paying for the acquisition of other customers.

Say you run a health and beauty subscribe and save program with a $50 average order value. Shopify estimates that for health and beauty eCommerce brands with fewer than four employees, the average customer acquisition cost is $127.

A customer who churns after two shipments hasn’t even covered the cost of their acquisition. If you can’t add customers fast enough to replace those who churn at this rate, your CAC costs may be outpacing revenue. If ad costs push the CAC to $150 the next year and your churn rates haven’t changed, your CAC returns will drop even more.

Reduces customer lifetime value (CLV)

It pays to keep subscribers engaged. By definition, subscribers buy from you repeatedly, which means they have a higher lifetime value than customers who buy once and switch to a competitor. Churn reduces a subscriber’s potential value.

If the average lifetime value of your subscribers exceeds the cost of acquiring them, it’s a sign you’ve managed churn well. Further comparing lifetime value and acquisition costs can lead to more business insights.

Let’s return to the health and beauty example. Your CAC is $127, but say your average CLV is $1,000. Your CLV:CAC ratio is almost 8:1. A ratio this high means you can allocate more marketing dollars to acquiring new subscribers.

How to measure subscriber churn

While some subscriber churn is inevitable, it’s important to retain enough subscribers to maintain profitability. Use your subscription platform to measure churn and gauge its impact on your business.

Customer churn rate

Customer churn refers to how much of your customer base cancels their subscriptions in a certain period of time.

Say you decide to measure customer churn on a monthly basis:

Customer churn rate = [(total number of customers at the beginning of the month – number of customers at the end of the month) / number of customers at the beginning of the month] x 100

If you start the month with 2,000 subscribers and end it with 1,900, your customer churn rate is 5%, which means your retention rate is 95%. While churn benchmarks vary by industry, your churn rate is too high if your CAC costs begin exceeding average CLV.

It’s also a good idea to calculate separate rates for voluntary and involuntary churn to see where you should focus your retention efforts.

This important metric evaluates the effectiveness of your customer retention efforts. Generally, it’s cheaper to keep existing customers than acquire new ones.

Revenue churn rate

Revenue churn, also known as MRR churn rate, looks at the percentage of revenue you have lost from churn in a given period.

It’s common to measure revenue churn on a monthly basis:

Revenue churn rate = (revenue canceling during the month / total revenue up for renewal during the month) x 100

If subscriber churn leads to a loss of $5,000 in a month, leaving $50,000 left to charge, your revenue churn rate is 10%.

Say you offer two beauty subscription box options — one for $150 per month and one for $300. If your revenue churn rate is high relative to your customer churn rate, it likely means your best subscribers — the $300-per-month folks — are the ones churning.

Use this metric in tandem with customer churn rate to view the full impact of churn on your business.

How to reduce subscriber churn

The only way to reduce subscriber churn is to get in front of the events that lead to churn. When you understand these events, you can take steps to prevent them.

Add value and convenience to reduce voluntary churn

Because voluntary churn is a conscious subscriber choice, find ways to increase their satisfaction with your subscription experience.

Constant messaging of your value proposition. Once subscribers become accustomed to receiving your products, they often need to be reminded why remaining a subscriber is in their best interests.

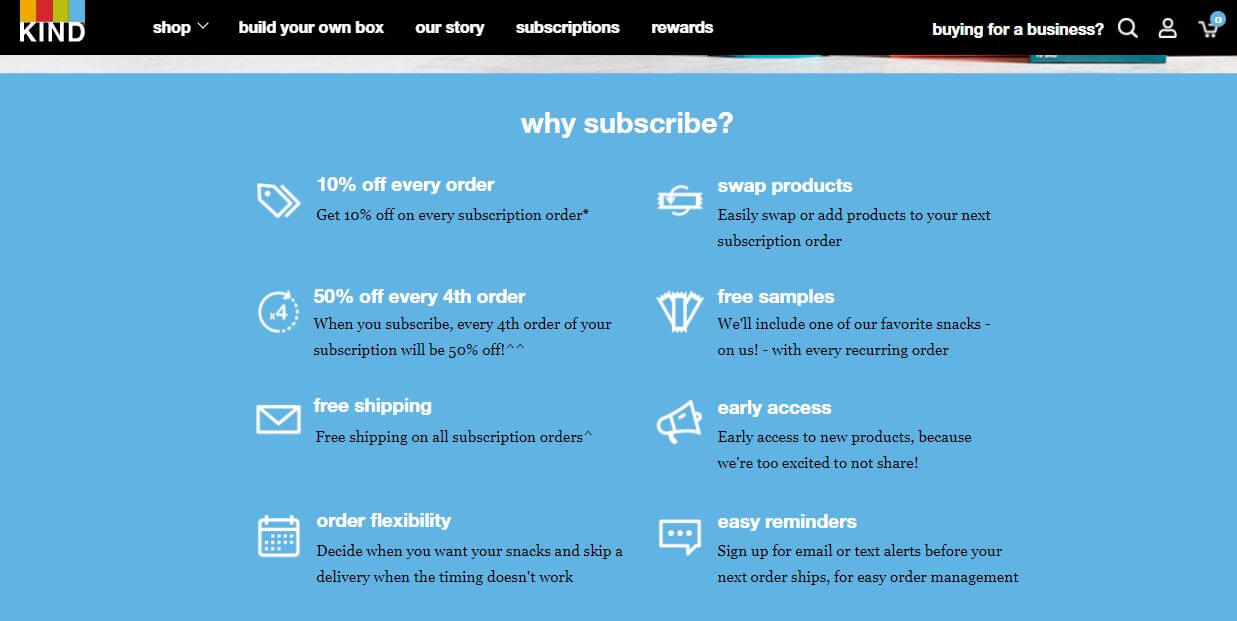

KIND Snacks offers subscribers 50% off their fourth order, hoping subscribers stick around long enough to take advantage of it.

Retention rewards can increase retention by as much as 10%.

Produce resources, templates, and guides to assist customers. If you offer a wide array of subscription products, encourage subscribers to try something new to keep their subscriptions fresh. Product guides, videos, or even podcasts can give them the confidence to branch out and become even more devoted to your brand.

CBDistillery offers a large variety of CBD products, including edibles and topicals, many of which are available in a subscription experience.

They offer a comprehensive CBD guide to help subscribers better incorporate CBD into their everyday lives. In tandem with a 20% discount and free shipping on every subscription order, plus 25% off every third order, they managed to grow their retention rate to 89%.

Ability to skip and order or swap a product. A subscription company must adapt to the evolving needs of the subscriber. Give them a customer portal where they can easily skip an order or swap out a product for a similar item.

According to internal Ordergroove data, when subscribers can skip an order, they remain in the fold for 135% longer. Our data also shows that subscribers last 71% longer when they have the ability to swap a product.

Scoutside founder and subscription expert Thomas McCutchen said, “The more that a customer is inside the (subscriber) portal, the more they feel in control and the longer they’ll stick around. They’ll start taking actions other than cancel.”

Leverage artificial intelligence (AI) to fight churn. One of the best ways to fight churn is to predict it. Some subscription platforms use AI to personalize customer experiences.

AI can help anticipate when subscribers are churn risks due to overstock. It can be used to trigger an email offering them the option to skip their next order (which subscribers often forget is an option). This can reduce churn by as much as 17%.

Be proactive to reduce involuntary churn

While you can’t keep tabs on the amount of money in subscribers’ bank accounts, you can still take proactive steps to reduce involuntary churn.

Notify customers of upcoming subscription payments. Much like notifying subscribers that they can skip a shipment due to overstock, notify them a week before an order ships with a request to update their credit card if necessary.

Use dunning management if notification fails. Dunning management automatically retries credit cards if payments fail the first time. If repeated attempts fail, send an email asking customers to update their cards.

Better yet, when subscribers enroll, ask their permission to collect updated credit card information directly from credit card providers. This practice can reduce the number of times you have to contact a subscriber.

Use subscriber churn to improve customer relationships

You read that right. If subscribers end up churning despite your best efforts, don’t make it difficult for them to do so. A difficult cancellation can remove whatever positive sentiment subscribers still have for your brand.

According to Rachel Saul, co-CEO of subscription strategy firm Chelsea & Rachel Co., “It’s really important to make that customer feel like they are leaving with a warm hug because if they love the brand, and most likely the majority of them do, they’ll be back.”

To learn more about how Ordergroove can help you reduce subscription churn, click here for a free demo.