Relationship Commerce

Thought Leadership

Cashing in an omnichannel opportunity: In-store subscriptions unlock more revenue and profit for brick-and-mortar retailers

For brands with brick-and-mortar locations, in-store subscriptions are probably the number one revenue opportunity for their business — whether they know it or not.

Bringing subscriptions in-store gives retailers new levers to pull for expanded wallet share, stronger unit economics, and predictable recurring revenue streams — all of which add up to a future proof business.

For brick-and-mortar retailers considering launching omnichannel subscriptions, there are a variety of considerations and tactics to consider before designing the subscriber experience. Ordergroove’s Director of Commerce Strategy, Eric Andrews, walks through how best to quantify the revenue impact and unit economic improvements of in-store subscriptions in his exclusive Ordergroove YouTube series.

Download a free copy of Eric Andrew’s in-store subscription revenue calculator template before we dive in.

Growing share of wallet enhances unit economics for brick-and-mortar retail

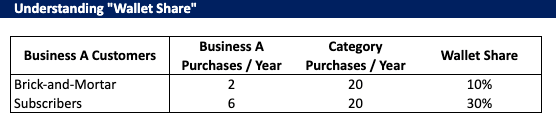

Wallet share refers to how frequently a retailer transacts with each customer, and how much each customer spends per year on a given category. As such, increased wallet share means more revenue from repeat purchases, cross-selling, and expanding overall market share — making it a great indicator for customer loyalty, competitive positioning, and long-term business growth.

Let’s say you have a business with brick-and-mortar locations, where each customer makes a purchase from you two times per year — but within the category you operate in, they make an additional 20 purchases per year from other competitors in your space. Since they only come to you for two of their 20 purchases in your category, you have 10% of their wallet share.

Share of wallet is a leading indicator for customer loyalty, competitive positioning, and long-term business growth — and to increase wallet share is to increase revenue from repeat purchases, cross-selling, and carving out a bigger footprint in the market in general.

But how can brick-and-mortar retailers grow their wallet share? That’s where in-store subscriptions come into play.

Consider what happens to your 10% wallet share if you start offering in-store subscriptions and manage to turn some of your existing customer base into subscribers. If those customers increase their annual purchases with you from two to six — thanks to the convenience and benefits of your subscriber experience — you’ve increased your share of wallet from 10% to 30%, meaning you get a bigger slice of the pie from the 20 purchases they make per year in your category.

But you’ve also unlocked an immediate improvement for the unit economics of your business by increasing your margins. The best part is, you did it by extracting more value from your existing customer base rather than taking on sky-high customer acquisition costs for net new customers, which we’ll touch on more later.

Modeling how much more revenue per customer your business would earn from in-store subscriptions

Now that we’re all on the same page and can agree that in-store subscriptions are a golden opportunity, let’s dive into what this could look like for a business’ revenue before and after launching in-store subscriptions based on conversion rate benchmarks from Ordergroove merchants.

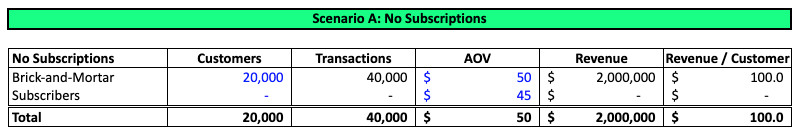

Let’s say you have a business with 20,000 customers who each purchase two times per year for a total of 40,000 transactions with an average order value (AOV) of $50. That means your business is making $2 million per year with each customer generating $100 of that revenue.

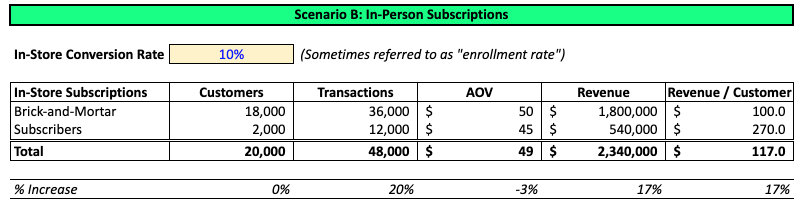

Now let’s look at what happens to your revenue if you launch in-store subscriptions and turn a subset of those 20,000 customers into subscribers. We’ll assume an in-store subscription conversion rate (also known as enrollment rate) of 10% based on common rates we see from retail merchants using Ordergroove — and that you offer a 10% subscriber discount to encourage customers to enroll in a subscription rather than continue with their single purchases.

That means you’ll wind up turning 2,000 of your 20,000 customers into subscribers, with an AOV of $45 after the enrollment incentive discount. If each of your 2,000 subscribers purchases from you six times a year while your remaining 18,000 customers still purchase only twice per year, you still grow your overall transactions by 20%.

But what about the AOV impact of that 10% subscriber discount?

Your AOV goes down about 3% due to the enrollment incentive, but the vast majority of your customers still have an AOV of $50 — and you’re still making 20% more transactions. The result is that your revenue would still grow 17% with subscribers spending $270 with you per year compared to $100 for non-subscribers.

These are real numbers we’re seeing among retail brands who take this approach, and the numbers make it pretty undeniable that in-store subscriptions are a game-changing tactic to boost brick-and-mortar revenue.

And these numbers are just within the first year! Imagine what happens if you turn even more customers into subscribers and make subscriptions a larger part of your business’ growth strategy over time…

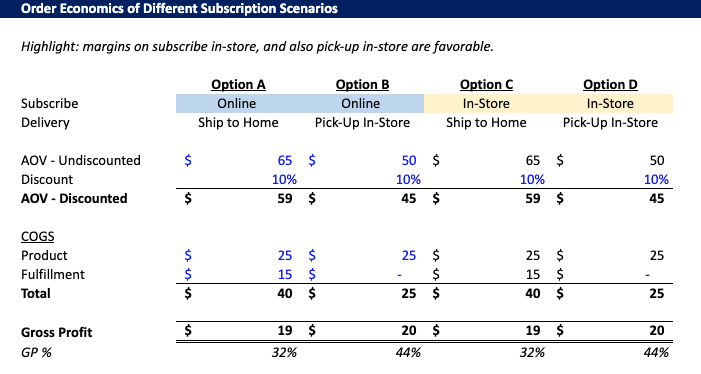

Calculating the unit economics for common in-store subscription models

We’ve established that in-store subscriptions bring about a significant lift in revenue out of the gate, but to truly understand and underscore just how much in-store subscriber experiences support profitability, we still need to evaluate the unit economics of common approaches for brick-and-mortar retailers.

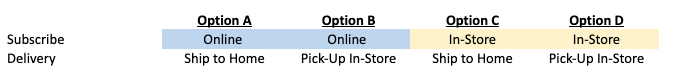

Whether a customer subscribes in-store versus online — or chooses to pick up their subscription in-store versus getting it shipped to their home — can make a big difference when it comes to contribution margins.

To set themselves up for success, brick-and-mortar retailers need to keep in mind which scenarios present the biggest financial upside for their business in order to guide customers toward the most profitable option — while still offering customers a convenient and frictionless experience that grows their wallet share over time.

For each option we’re evaluating, we’ll assume the same base figures for in-store subscriptions with an AOV of $45 after the 10% enrollment incentive discount so we can focus on the difference shipping versus in-store pickup makes on profitability. In our example, we’ll say shipping is an extra $15 and factor that into the AOV for those who want everything shipped straight to their home.

From a cost of goods sold (COGS) standpoint, we have the cost of the product — which we’ll say is $25 across these scenarios — and a fulfillment cost of $15 for the options requiring shipping.

The COGS across these scenarios does vary at $40 for options requiring shipping versus $25 for in-store pickup. The gross profit stays pretty much the same within a one dollar difference across these scenarios, but the in-store pickup options offer a higher gross profit margin as a percent of revenue.

Not only that, but the option to pickup in-store creates valuable foot traffic that often leads to a halo effect where customers purchase extra items — further increasing your share of wallet — whenever they come in for an order pickup.

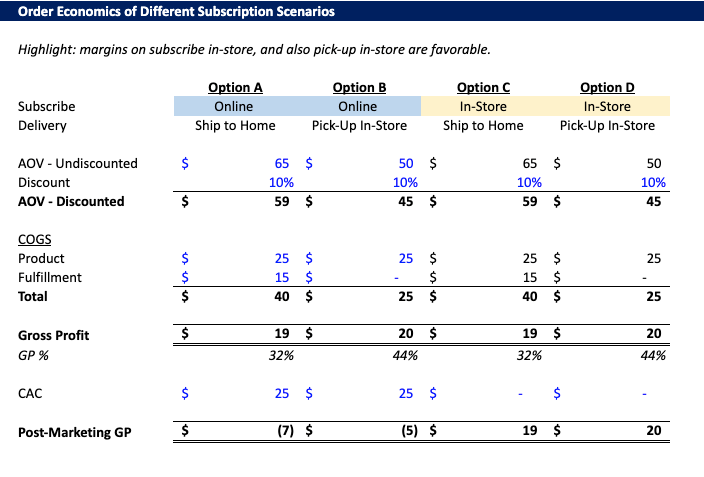

All of that said, no discussion of profitability would be complete without a closer look at customer acquisition — and on that front, it’s brick-and-mortar businesses in particular that have a major advantage compared to exclusively online eCommerce shopping experiences.

Using brick-and-mortar retail locations as the ultimate acquisition channel

Generally speaking, to acquire customers online and turn them into subscribers, merchants have to invest in marketing tactics that drive traffic to their website and nudge them through the funnel until they enroll in a subscription.

Even if organic traffic is on their side, most large retailers run paid marketing campaigns to help acquire new customers — so for this example we’ll assume a blended CAC of $25.

When you factor the $25 CAC into the $19 or $20 gross profit for subscribers who enroll online, you’ll find that the post-marketing gross profit is actually in the red for the first order — negative $7 for orders shipped to home or negative $5 for in-store pickup, respectively.

That’s just the first order, however. As the customer makes more purchases, they’ll become more profitable over time.

But the advantage of acquiring customers and handling subscription enrollment in-store is that CAC is effectively considered zero. Immediately from a post-marketing gross profit standpoint, enrolling subscribers in-store leads to more profit per customer from the moment they place their first order — not even including all of their halo purchases down the line.

Therein lies the crux of this golden opportunity: in-store subscriptions are how brick-and-mortar retailers can unlock new recurring revenue streams from an existing customer base with little to no marketing costs, and set themselves up for long-term profitable growth on and offline.

Omnichannel subscriptions are the key to boosting brick-and-mortar revenue and profits

The in-store subscription revenue calculator template is here to help you run the numbers for your own business. The broader takeaways for brick-and-mortar retailers are that physical store locations are a highly profitable acquisition channel for enrolling subscribers — and you can expect favorable profit margins when you also give those subscribers the option to pick up their orders in-store.

If you’re a fast-growing eCommerce/retail business doing $1M+ in subscription revenue and want to customize your subscription experience, reduce churn, or migrate off a homegrown system to lower your technology costs, come book a demo with us and you’ll be eligible for 10% off your annual contract value by mentioning Eric or the in-store subscription revenue calculator template.