Relationship Commerce

The concise guide to consistent subscription revenue growth

In 2020, the value of the US subscription eCommerce market hit $34.7 billion. That growth is not stopping. UnivDatos Market Insights projects the figure will exceed $2.64 trillion by 2028. Now is the time for eCommerce companies to embrace subscription revenue models to capture their slice of the revenue.

The path to adopting a subscription revenue model – also called a recurring revenue model – is attractive, but it does involve choices. Choices about which subscription model to use, for instance. However, success won’t come from simply duplicating what the competition is doing.

Your subscription revenue model must work hand in hand with the type of product or service you offer, pricing decisions, as well as what your customers want or need. When these considerations align, your subscription model will deepen customer relationships through convenience and value.

What is subscription revenue?

Subscription revenue is business income generated on a recurring basis. This revenue model succeeds when a business is able to ship customers a consumable product at regular intervals, often with a discount or free shipping attached to each order.

The base price of a subscription accounts for most recurring revenue. But there is room to grow subscription revenue with product upsells or cross-sells and different subscription tiers that add value in exchange for a higher monthly price.

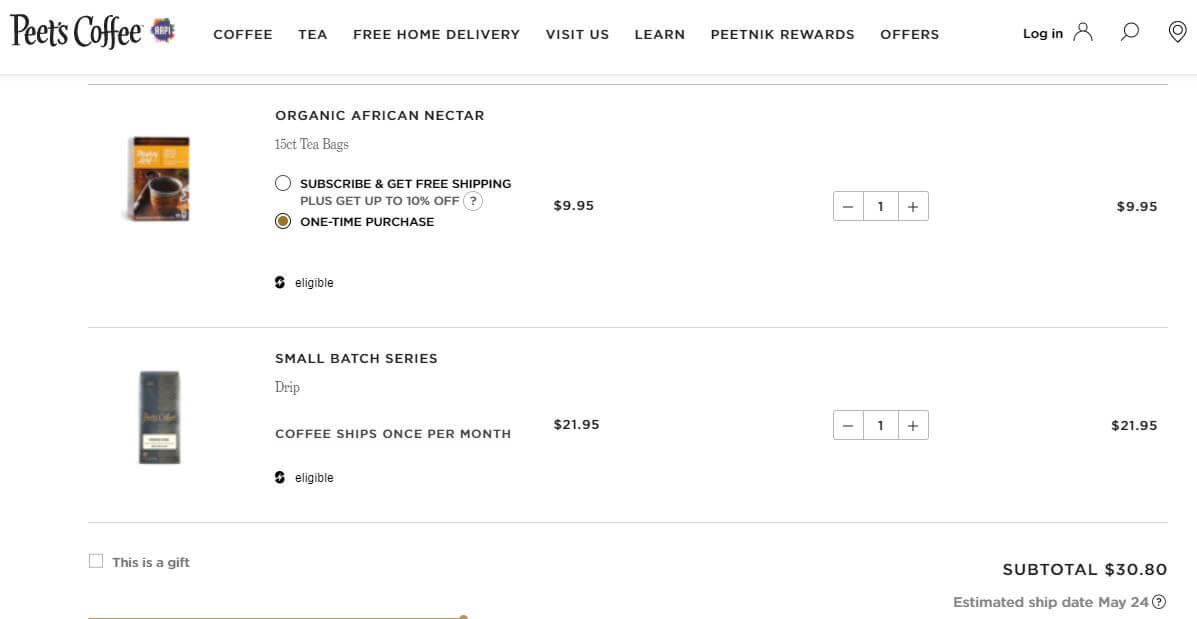

Coffee subscription service Pete’s Coffee makes it easy to add one-time purchases to subscription orders.

The customer is able to add a coffee subscription and box of tea to the same shopping cart. Even if a subscriber takes advantage of this option a few times per year, you’ve managed to increase their average order value (AOV).

What are the advantages of a subscription revenue model?

The advantages of a subscription revenue model go beyond a predictable revenue stream. Taken together, these advantages lead to sustainable growth for subscription companies.

Higher customer retention

Customer retention is built into the subscription revenue model. If a customer needs a certain amount of coffee each month, and you save them the trouble of placing a new order each time they run out, they’re more likely to stick with you.

Subscriptions build habits as customers get used to your products and services. As a result, your subscription business becomes the “default” provider of goods or services customers need on a regular basis. As they keep buying, their customer lifetime value increases as well.

Offset customer acquisition costs

According to a 2021 study by Iterable, increased customer acquisition is the top priority for 65% of marketers. With such competition for new customers, the cost of acquisition goes up.

Subscriptions offset customer acquisition costs by extending customer lifetime value. Instead of purchasing one item, subscribers purchase multiple items over time. Think of it this way: You can afford to spend $50 to acquire a customer when you know they’ll send $25 on their subscription per month for a whole year. You’re spending $50 to make $300.

Additionally, long-term subscribers will likely recommend your subscription experience to their friends when motivated with the right incentives. This further lowers acquisition costs, as word-of-mouth recommendations are more likely to convert.

Improved business forecasting

Subscription revenue models improve your ability to forecast revenue and inventory needs from month to month or quarter to quarter.

Say your coffee subscription service has 500 monthly subscribers. You know exactly how many pounds of coffee to have on hand each month and the revenue those pounds will deliver. The last thing you want is to have excess product or overstock – which adds to storage costs – or not enough to satisfy demand. An inability to meet subscriber expectations leads to higher rates of churn.

Subscription revenue model considerations

Subscription based business models involve a different set of considerations than traditional business models. If you fail to acknowledge these considerations, your subscription won’t deliver all the benefits you expect.

Is your product or service appropriate for a subscription? Most consumers don’t replace flat-screen televisions on a monthly basis, so those products aren’t the best fit. Products such as diapers, razors, and makeup are more appropriate.

Can your eCommerce platform support subscriptions? Given the advantages of a subscription revenue model, your eCommerce platform should make it a no-brainer for you to set up a subscription experience. They should either have their own subscription capabilities or integrate with leading subscription platforms like Ordergroove.

Can your logistics provider keep up with regular shipments and special packaging needs? If your subscription products go out on the 15 of every month, your logistics provider will have a busy day, especially if they need to assemble boxes containing multiple products with three colors of tissue.

Can your billing software handle recurring payments? The biggest advantage of starting a subscription business – recurring revenue – won’t matter if you can’t charge a credit card at the same time each month, or escalate situations where credit cards expire.

Subscription revenue pricing models

Non-SaaS subscription products and services generally fit into two pricing models, each with its own advantages. These subscription pricing models are not the same as subscription types. Subscription types — like subscribe and save, curated subscription boxes, and membership — relate either to the method of delivery or value provided to the customer, not pricing.

Flat-rate pricing

With flat-rate pricing, every subscriber gets the same goods and services at the same price over the same period. There are no add-ons or special packages.

The simplicity of this approach has at least two potential advantages. First, it can be easier to predict revenues without various potential combos and price points to account for. As a result, metrics like monthly recurring revenue (MRR) are easy to track.

Second, flat-rate pricing keeps things easy for customers, especially in the subscribe and save type. The clarity of “Here’s what you get, and this is what you pay” reduces friction at checkout. Customers don’t get lost comparing different options. The paradox of choice is removed. This can help move shoppers along the buyer journey faster.

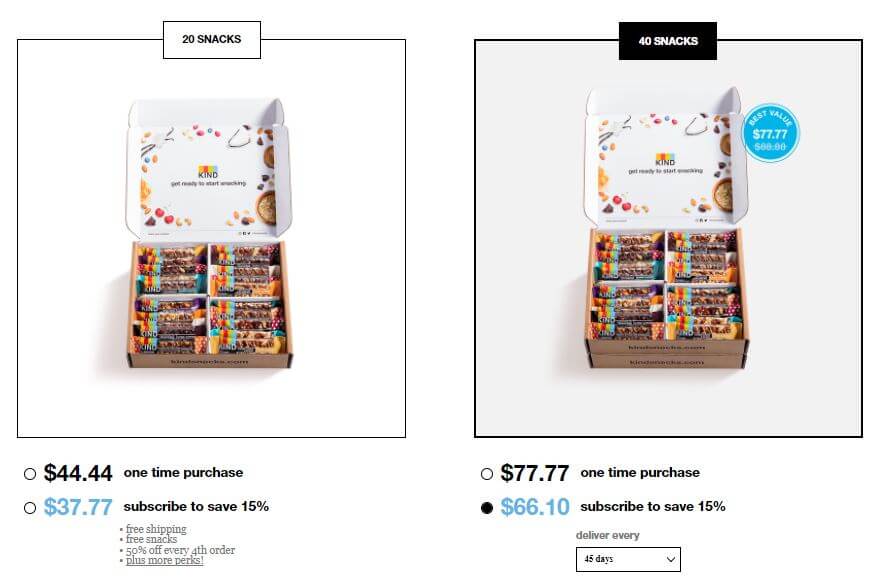

KIND Snacks charges the same base price (before discounts) for each of its subscription box shipments. For example, a subscriber pays $66.10 for a box of 40 snacks regardless of how frequently they receive each shipment.

This makes calculating the price easier for the consumer and simplifies the price structure for the company.

Tiered subscription pricing

Starting from a baseline freemium or lowest-cost option, customers can pay more for additional products, services, or benefits. The most expensive option should offer the most value or functionality to the customer.

Flexibility is a strength of tiered subscription pricing. Each tier can serve customers with different budgets. That way, you make the most of those customers with more money to spend. At the same time, you still reach customers who need lower price points or who are not yet convinced that the higher tiers are worth paying for.

Tiers let you increase the value of your customers over time. A shopper who starts at the lowest tier may like the product or service and choose to upgrade. Alternatively, they may be unable to afford the highest tier initially, but as their income grows, they can upgrade their service.

This works inversely, too. Subscribers at higher tiers may not have to cancel their monthly subscription completely when tightening their belts — reducing your churn rate by preserving existing customers. Even a freemium option can entice prospective subscribers to join, reducing the need to acquire new customers.

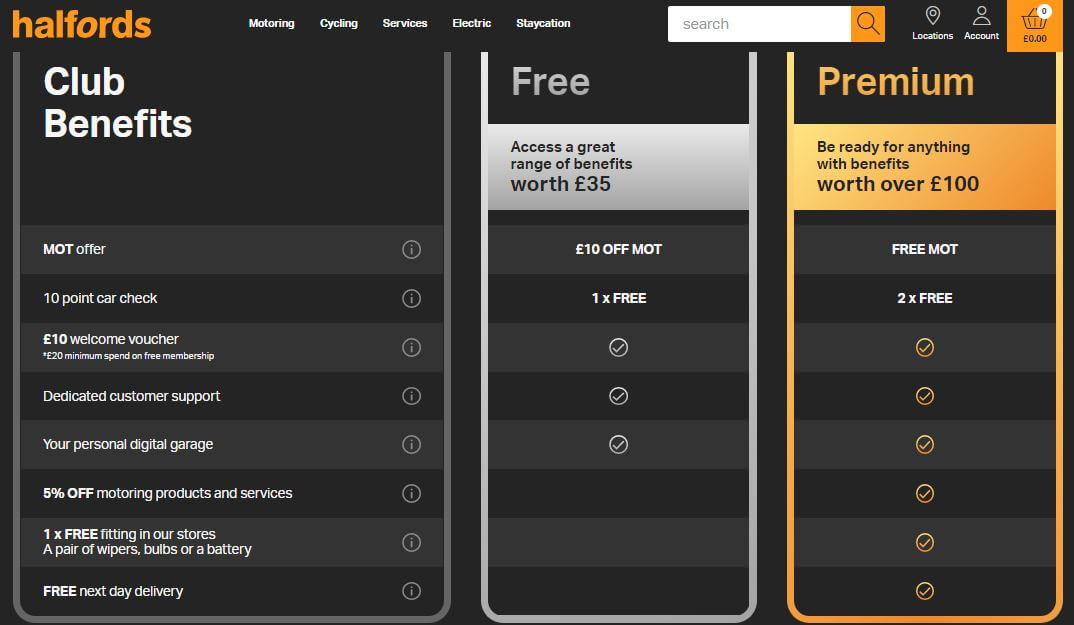

Tiered pricing is common for membership subscription types. Take leading UK automotive and bicycle retailer Halfords.

Halfords offers tiered club membership benefits, including free next-day delivery and 5% off motoring products and services at the premium level.

How to calculate subscription revenue

As subscription rates are a form of MRR, we can use that as the basis for calculation. The formula can easily be adapted if you want to use annual recurring revenue (ARR) instead.

Total average MRR

Multiply the number of subscribers by your average revenue per customer. This gives a rough average for your total earnings in the given period.

Total average MRR = Total Subscribers * Average Subscription for Period

MRR by subscription tier

Businesses with different plan levels or clear groups of customers may require a more precise formula. For greater accuracy, calculate each group of customers at each price point separately before adding them together.

Say your basic plan costs $10 and your premium plan $15. You have 150 basic subscribers and 100 premium subscribers. Multiply 10 ($) by 150 for subscription revenue to find the basic plan total ($1,500). Multiply 15 ($) by 100 for your premium subscribers ($1,500). You’d then add these figures together for $3,000 of subscription revenue.

MRR by subscription tier = (Total Subscribers in Plan A * Cost of Plan A) + (Total Subscribers in Plan B *Cost of Plan B) in a set time period

How to develop a subscription pricing model

Rather than think of different subscription revenue models as totally distinct, you might find it best to adopt a flexible and experimental approach.

Suppose you want a simple pricing model for subscribers but don’t want to drag down your AOV. You could offer a single standard subscription rate without multiple tiers but enable instant upsells.

Ultimately, it all comes down to your product-market fit. Give yourself the room to learn, grow, and make data-driven decisions so you can hone your pricing model over time.

Request a demo to see how Ordergroove can help automate subscription management and deliver a subscription revenue model that works for your business model.