How to calculate CAC payback period for subscription businesses accurately using cohort analysis

If you’re already tracking crucial metrics for your eCommerce subscription business, you might be well aware that customer acquisition costs (CAC) have surged 222% over the last decade — and that there are implications beyond the upfront expenses.

Now more than ever, brands and retailers need to get crystal clear on how long it takes to earn back the money they’ve invested in acquiring new customers. Otherwise, they run the risk of investing resources in the wrong acquisition channels, retention marketing plays, and pricing strategies.

But most subscription merchants forget to factor customer cohorts into their CAC payback period calculation, setting them up for quite the surprise when they discover it takes double — or even triple — as long as they expected to break even on acquisition.

The good news is that Eric Andrews, Ordergroove’s Director of Growth, is here to help with a CAC Payback Framework template that will spare you any catastrophic miscalculations.

Don’t forget to grab your own copy before we dive into some background info to get us all on the same page.

What you need to know before calculating your CAC payback period

Let’s start with the basics.

Terms and definitions

Customer acquisition costs (CAC)

This is the total direct and indirect cost of converting a member of your target audience into a paying customer (or subscriber) for the very first time

Gross profit or gross margin

This is the product-level profit you make off a customer or subscriber before factoring in operating costs, which can look different for each type of subscription business.

For software subscription businesses, you’d take revenue minus the cost of things like web hosting and customer support. For eCommerce or retail subscription businesses selling physical products, you’d also subtract the cost of manufacturing and fulfillment for a given product.

In other words, gross profit or gross margin is calculated by subtracting the cost of delivering the product to the customer from the overall revenue earned from the product.

CAC payback period

This is the reason you’re reading this — it’s how long it takes to make back in gross profit what you spent on CAC.

Think of it as the point at which you break even on your investment in acquiring a brand new customer or subscriber. After you break even, all the future money you generate off that customer or subscriber is counted as profit.

Customer cohort

This is what most subscription merchants mistakenly leave out of their CAC payback period calculations — it’s a group of customers or subscribers that all purchased from you for the first time in the same month, who you can then track over the course of their lifetime as customers.

With all of that said, you’ll also need to determine —

Should CAC payback period be measured in months or number of orders?

One quick thing to note is that the CAC payback period can be measured in months or in number of orders, so you’ll need to decide which makes more sense for your business.

If you’re selling software subscriptions that are billed every 30 days, you should measure monthly. But if you’re selling physical products as a subscription where subscribers might choose different order frequencies — or even skip an order from time to time — then you should use number of orders to measure the CAC payback period.

The biggest mistake to avoid with your CAC payback calculation

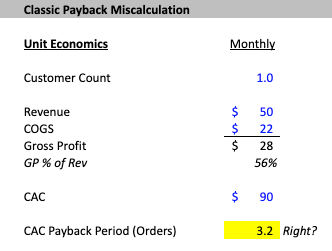

We see this classic payback miscalculation over and over again:

For one subscriber I make $50 per month in revenue. The cost of goods sold (COGS) is $22 per month. That means my monthly gross profit is $50-$22, which is $28.

I spent $90 to acquire the subscriber, so I would make back my CAC of $90 in 3.2 months, because $90/$28 = 3.2… right?

Download our free CAC Payback Period Template!

Learn how to correctly calculate the CAC payback period for a subscription-based business using cohort analysis and avoid common mistakes that can lead to costly miscalculations.

It may seem logical that if you make $28 in profit in month one, $28 in month two, and $28 in month three — for $84 in profit at that point — that 3.2 months is how long it would take to earn back your CAC.

But that’s completely wrong.

The issue is that this calculation assumes that your churn rate is zero, which would mean that subscribers never *ever* cancel — and unfortunately that’s not the reality for most businesses.

The reality looks more like this: Let’s say you acquire a group of subscribers who all made their first order in the same month, but by the time the second order date rolls around, a bunch of them have already canceled their subscription.

That would mean that your gross profit is not the same as the months progress — it’s less in month two — and it may even decline again in month three. But the CAC is always the same as it was in month one, because you had to pay to acquire those subscribers, even if they churned in month two.

So, 3.2 months for CAC payback doesn’t represent the dynamics of your subscription business because subscribers can churn at many different points in their lifetime.

That’s why you need to do a cohort analysis to understand how much money you allocated for customer acquisition for that specific group relative to how much cash they generated to pay back the CAC.

The right way to calculate the CAC payback period using customer cohorts

Now, let’s talk about the right way to do this using two common scenarios.

Scenario 1: eCommerce or retail subscription businesses

The first scenario is for eCommerce or retail subscription businesses who sell physical products and likely have a higher churn rate.

For simplicity, we’ll use the same unit economics as the last example —

For one subscriber I make $50 per month in revenue. The cost of goods sold (COGS) is $22 per month. That means my monthly gross profit is $50-$22, which is $28. And I spent $90 to acquire the subscriber.

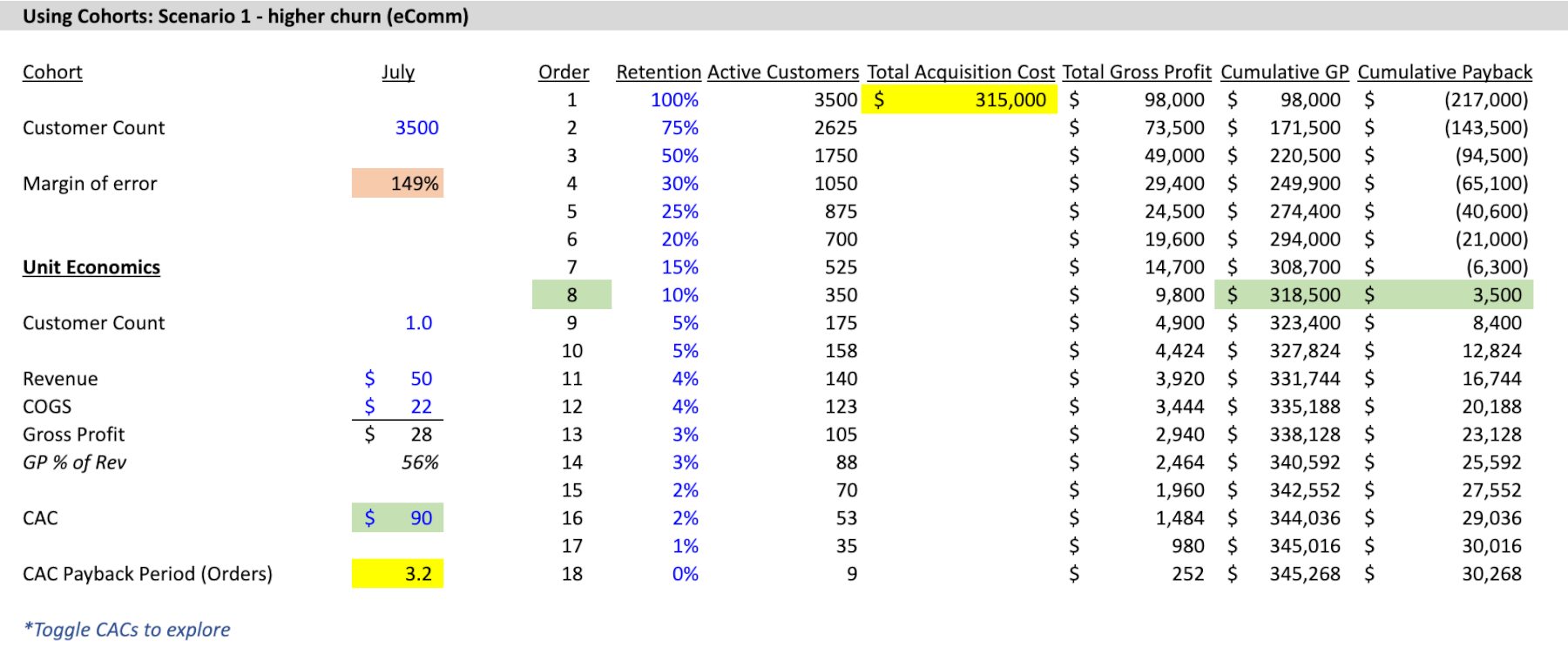

To avoid the classic miscalculation, we’re going to track a cohort of 3,500 subscribers who all placed their first order in the month of July and analyze the financial impact of that group on the business, making sure to factor in churn.

So, here you can see the lifetime orders and the retention figures for those 3,500 subscribers:

Download our free CAC Payback Period Template!

Learn how to correctly calculate the CAC payback period for a subscription-based business using cohort analysis and avoid common mistakes that can lead to costly miscalculations.

Retention for the first order is 100% because they all placed the first order — landing them in this cohort in the first place — but only 75% of those 3,500 subscribers actually made it to the second order. And by the third order, we only have 50% of those subscribers.

And if you follow this all the way down the table, you’ll find that retention continued to drop off and most subscribers churned by the time order 18 came around — which is pretty standard for eCommerce and retail subscriptions.

We spent $90 to acquire each subscriber initially, which means we spent $315,000 total to acquire this cohort of 3,500 subscribers.

If our gross profit per subscriber is $28, then those subscribers generated $98,000 total for our business with their first order (3,500 x $28 = $98,000).

However, by the second order, the profit stream declines because we only have 2,625 subscribers — and they generated $73,500 (2,725 x $28 = $73,500).

And the gross profit continues to decline with each order. So the big question is, if we add up the gross profit from each round of orders, at what point do we cumulatively generate enough to pay back that initial CAC of $315,000?

According to our calculations, it’s not until this cohort reaches order eight that we finally clear $315,000 in cumulative gross profit.

Assuming that subscribers place a maximum of one order per month, it will take at least eight months to pay back our CAC — a pretty far cry from the 3.2 month payback period we came to before using customer cohorts.

Imagine allocating millions of dollars to CAC, assuming that your break-even point is 3.2 months, but it’s actually eight months.

That’s a 150% margin of error — and almost three times as long as expected — which tends to be a really big issue for businesses.

Scenario 2: Software subscription businesses

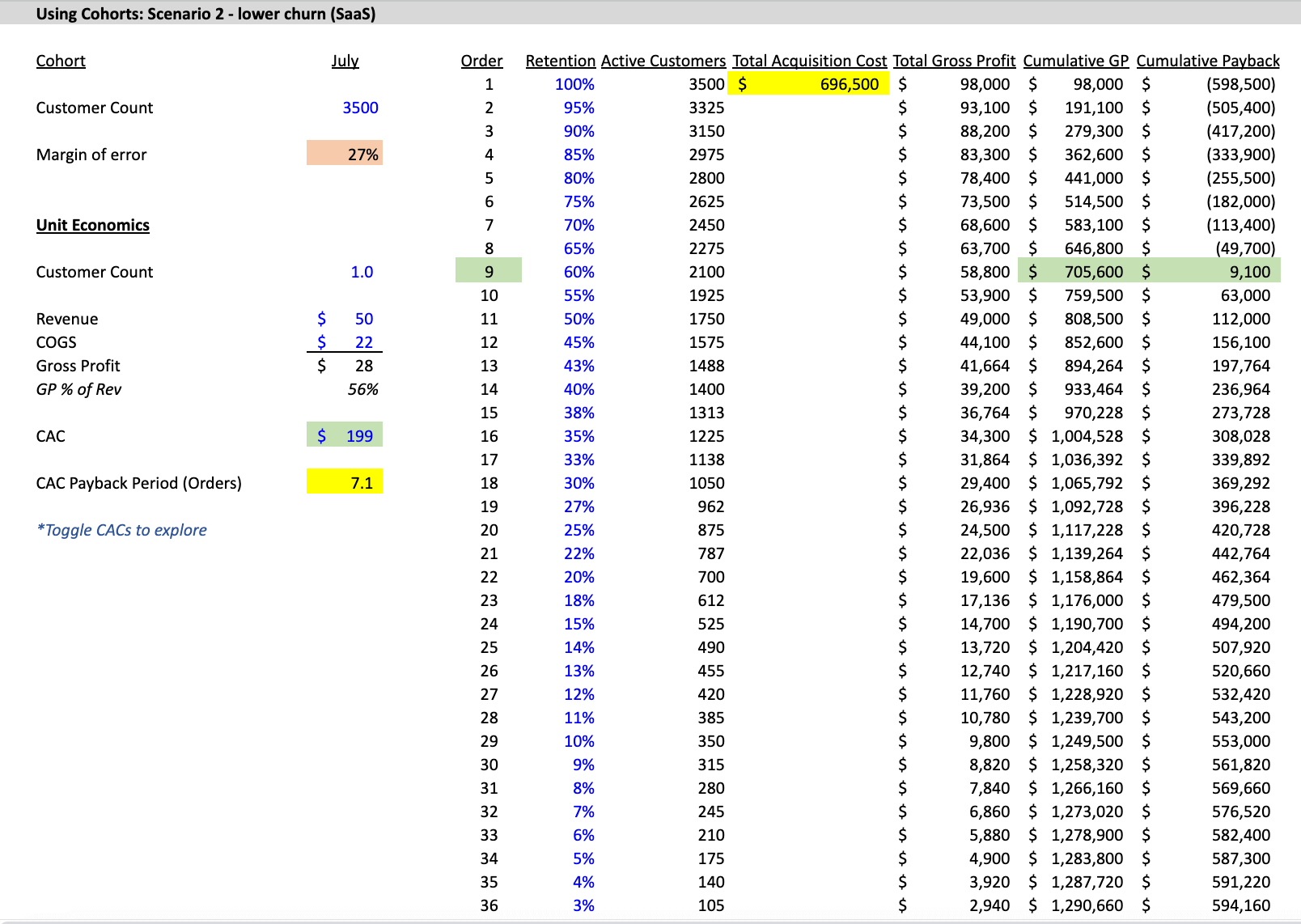

Now let’s look at a different example, this time for a business selling monthly software subscriptions that happens to have a lower churn rate.

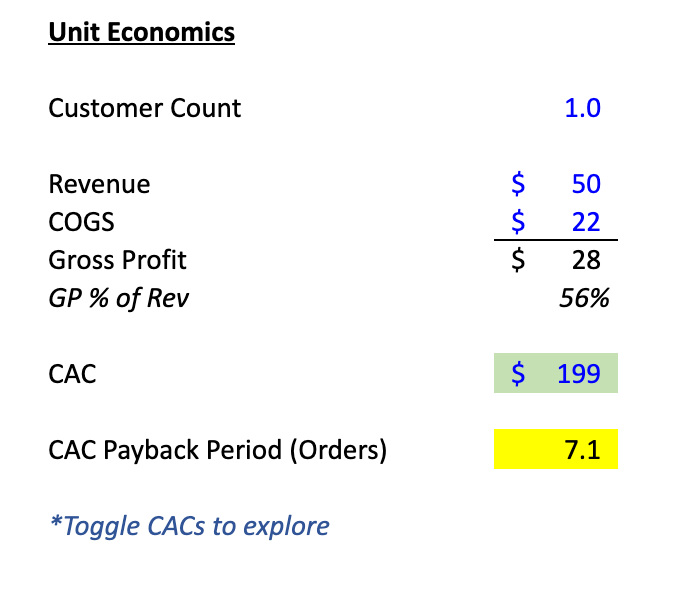

The unit economics will stay almost exactly the same, but we’ll increase our CAC from $90 to $199 to reflect how SaaS businesses usually operate — because software subscriptions usually have higher retention rates and stronger gross profit margins, they can invest a lot more in acquisition efforts.

So, in this scenario we spend $696,500 total to acquire our 3,500 subscribers. And if we were to fall into the trap of the classic miscalculation, we’d get a CAC payback period of 7.1 months.

By now we know that’s wrong — so let’s recalculate it using customer cohorts to see how long it really takes to recover our investment in acquisition.

Download our free CAC Payback Period Template!

Learn how to correctly calculate the CAC payback period for a subscription-based business using cohort analysis and avoid common mistakes that can lead to costly miscalculations.

Looking at retention over time, you’ll see a much more gradual decline than we had in the first scenario — and it’s not until 36 months down the line that most of our subscribers have churned.

That means we have a lot more subscribers generating profits for us for a much longer period of time, which changes the magnitude of a potential miscalculation. But just like last time, we have to look at cumulative gross profit to figure out when we’ll make back the $696,500 we spent to get those 3,500 subscribers in the door.

Per our calculations, it’s not until month nine that we generate enough cumulative gross profit to pay back our $696,500 in CAC.

So, our miscalculation of 7.1 months for payback had a 27% margin of error. That means that it takes 27% longer than we thought to make back each and every dollar we put into marketing — which may not be earth-shattering, but it isn’t ideal either.

Now let’s draw some logical conclusions from these examples.

What CAC payback period really means for your business

From the scenarios we just played out, the first takeaway is that higher-churn businesses have more sensitive CAC payback dynamics than businesses with lower churn rates.

In the first scenario for eCommerce and retail subscription businesses with higher churn, we managed to pay back our CAC. But after that, we barely squeezed out any profit. So, that business has some fundamental issues with its unit economics, and should probably rethink its pricing strategy and budget allocation ASAP.

But in scenario two, for software subscription businesses with lower churn, we managed to pay back a much higher CAC — and still take home some profit — all thanks to a large active subscriber base and better retention. And the stronger unit economics in this scenario mean the business is in a much better position to generate cash flow and continue to grow if it keeps doing what it’s doing.

But to be clear, the amount businesses spend in CAC matters too — and even small fluctuations can dramatically impact the overall performance and profitability of a business. That’s why it’s so important to have a calculation framework for a range of scenarios.

The major takeaways

- Higher churn businesses have more sensitive CAC dynamics.

- But even the smallest changes in CAC can have an outsized impact on the payback period — and, by extension, business performance.

- Miscalculating your CAC payback period can be catastrophic if you’re burning money faster than your cash flow can keep up with.

It should be plain to see why it’s so important to understand the payback period for your business investments — and with Eric’s CAC Payback Framework template you can be sure of your findings.

If you’re a fast-growing eCommerce/retail business doing $1M+ in subscription revenue and want to customize your subscription experience, reduce churn, or migrate off a homegrown system to lower your technology costs, come book a demo with us and you’ll be eligible for 10% off your annual contract value by mentioning Eric or the calculator template.