4 reasons CFOs want eCommerce subscriptions

Today’s consumers are bearing the brunt of inflation. The BLS reports that consumer prices in January 2023 are 6.4% higher than in January 2022. When everyday necessities get more expensive, shoppers look for value.

Subscriptions fill that need since they’re usually more affordable than one-off purchases and save consumers time. Subscriptions also fill a business need by driving more recurring revenue and extending customer lifetime value (LTV).

But your CFO might not feel the same way. They might wonder how much subscriptions cost to implement, how many additional staff members they need to hire to manage them, and how quickly they’ll see a positive return on investment (ROI). PwC finds that 47% of CFOs say their top 2023 priority is “building predictive models and scenario analysis capabilities” to combat economic uncertainty.

The good news is subscriptions align with the goals CFOs care about. Mention these benefits in your proposal, and you’ll have a pro-subscription CFO in no time.

1. Higher customer lifetime value

Brands often incentivize shoppers to sign up for subscriptions by offering a slight discount. Your CFO will love hearing that subscriptions still increase LTV despite these promotions.

LTV is a critical metric for CFOs because it’s an indicator of business stability. Subscribers offer more business-stabilizing revenue than one-off shoppers because they agree to receive recurring shipments.

With pay-as-you-go subscriptions, customers pay on an ongoing basis, usually monthly, as shipments go out. Prepaid subscriptions, on the other hand, let subscribers pay upfront for a set term beyond a month.

Both subscription types increase LTV. Pay-as-you-go subscriptions, on average, have three to four times the LTV of one-time shoppers. Prepaid subscriptions, on the other hand, have an LTV that is, on average, four times higher than pay-as-you-go subscriptions.

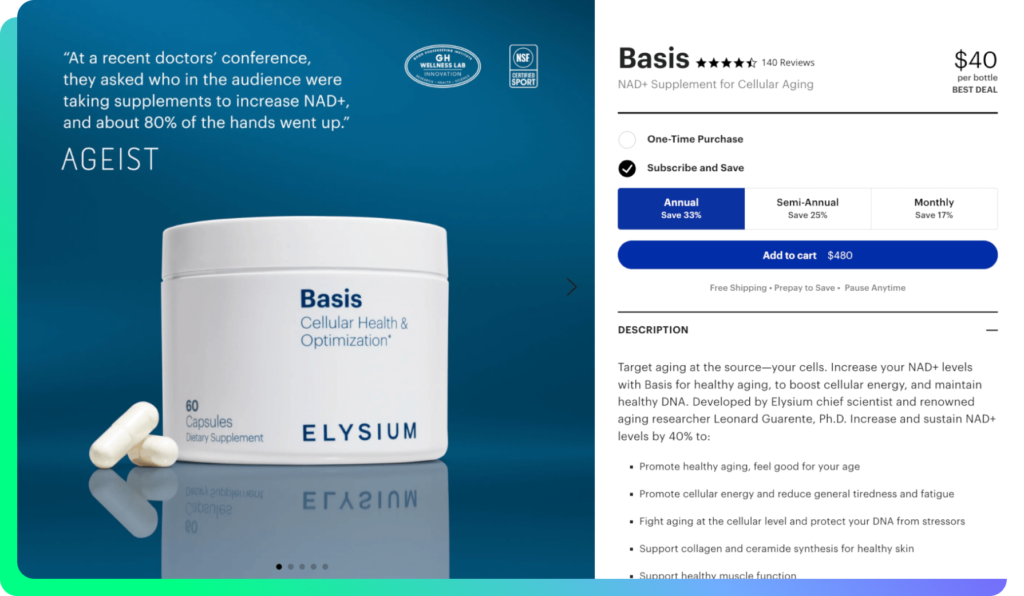

To accommodate more customers, prepaid subscriptions can live alongside pay-as-you-go subscriptions in your eCommerce store. Elysium Health even gives shoppers two prepay options: Pay upfront for 12 months or six months.

Image source. Elysium Health’s subscription enrollment experience.

Top-performing subscription platforms help increase LTV even more by letting subscribers easily add products to their recurring shipments. You might want to upsell a coffee subscriber on a new grinder. The subscriber can add it to an upcoming shipment with a couple of clicks. You’ve increased not only their average order value but also their LTV.

Objection handling: But what about high subscriber churn?

A CFO will understand the connection between subscriptions and higher LTV. But they might ask about the cost and time needed to maintain a subscriber base. Since subscribers are so valuable as customers, the last thing they want is a high rate of subscriber churn.

With the right subscription platform, you and your team can combat churn with ease. Some platforms will alert you if a subscriber is about to experience overstock and automatically send the subscriber a message suggesting they skip an upcoming shipment.

Subscribers also churn against their will, like when their credit cards expire. Top subscription providers use dunning management to retry cards and retrieve updated information, so your team doesn’t need to reach out to customers one by one.

2. Lower upfront costs and internal maintenance with a subscription platform

A seamless subscription experience largely depends on using a subscription tool. Your CFO will want to know how long implementation takes and how much the platform costs.

To build a homegrown subscription solution, you’ll need to hire additional software engineers and pay for constant system maintenance. The process isn’t flexible and puts financial and resource constraints on companies.

On the flip side, your team can adopt a subscription platform that’s ready to go with the functionality you need. Look for a platform with a developer-friendly framework and APIs that enable you to offer a unique subscription experience.

The platform should also integrate seamlessly with your preferred eCommerce platform, so subscribers aren’t forced to leave your site to checkout. Called a “hijacked” checkout, this type of experience can decrease subscription enrollment by 40%.

Objection handling: But what about operational costs?

It’s one thing for your development team to have a good experience integrating and maintaining a subscription platform. But what about other departments? Your CFO will love to know how subscriptions impact other departments’ operational costs.

The marketing team will need to create unique content for subscribers — like sending shipment reminders and subscription anniversary promos. A good subscription platform should help them complete these tasks as seamlessly and cost-effectively as possible. For instance, they should have email templates and messaging you can use.

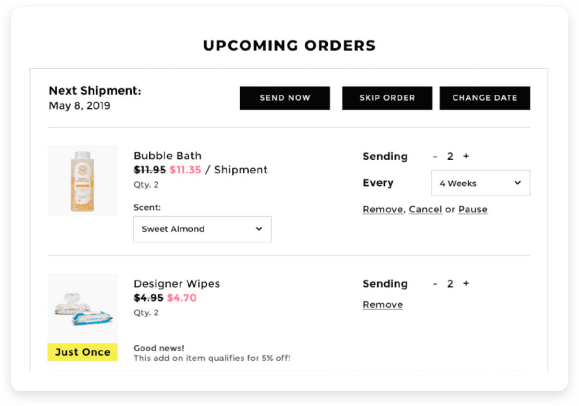

If you partner with a premium subscription solution, there should be a minimum impact on your customer success team. Premium subscription solutions offer an intuitive subscriber dashboard where subscribers can independently skip an order, swap out an item for a new one, and even pause a subscription without canceling.

Image source. The Honest Company’s subscriber dashboard.

Giving subscribers complete control over their orders does more than reduce support tickets. It also combats churn. According to internal Ordergroove data, subscribers last 135% longer when they can skip an order and 71% longer when they can swap a product.

3. Improved ROI of customer acquisition costs (CAC)

Rising CAC is a major concern for CFOs. Insider Intelligence predicts U.S. digital ad spending alone will hit $250 billion in 2023, up from almost $221 billion in 2022. One reason for the jump in CAC is the decline in brand loyalty. Salesforce learned in 2022 that 71% of consumers had “switched brands at least once in the past year.”

Subscriptions offset CAC since subscribers typically purchase more often and for longer time periods than one-off shoppers.

Say you spend $100 on an Instagram ad to acquire a customer who spends $50 on a product before churning. Now suppose you spend that same $100 on an ad promoting the same product as a discounted subscription. The ad convinces a customer to sign up and pay $45 every month over the next year.

The subscriber receives a $5 discount each month. But their subscription offsets the CAC and generates $490 more than the one-off shopper who only spends $50.

Here’s how to explain it to the CFO. Subscribers stretch CAC dollars further than non-subscribers and provide a consistent cash flow that helps stabilize the business.

What do I tell my CFO? Subscriptions give one-off buyers another option

CFOs understand that acquisition costs are a fact of life. But they might wonder how to promote subscriptions and attract customers who want to try the product first before committing.

The reality is subscriptions can live alongside a one-off eCommerce purchase option.

Image source. CBDistillery’s subscription enrollment experience.

Buyers can see the advantages of subscribing at the point of purchase, from a deeper discount to free shipping. But nothing prevents them from buying once to try the product out.

4. Better revenue and inventory forecasting

Business forecasting isn’t getting any easier for CFOs. In a 2022 Gartner report, 36% of CFOs called forecasting one of their “most difficult tasks to manage for the next 12 months,” second only to hiring.

Ordergroove VP of Finance Eric Rosen says the “steady cash flow” subscriptions provide “makes it easier to predict revenue.” With churn rate and enrollment rate reporting, CFOs can also accurately gauge how much inventory they’ll need to fulfill these subscription orders.

CFOs will love how they can minimize dead inventory with reliable predictions from subscriptions. The last thing they want is higher warehousing costs from unsold merchandise.

What do I tell my CFO? Subscriptions “inflation-proof” your business

Even with solid revenue and inventory forecasting, inflation can wreak havoc on projections. Consumers might suddenly pull back on spending, leaving much of your two quarters’ worth of revenue sitting in the warehouse. Your CFO might want to know if subscriptions are an answer to sudden shifts in demand.

Because subscriptions offer maximum value and convenience, you’re in a much better position to keep subscribers than businesses that depend on one-off sales only.

Boost business stability by partnering with Ordergroove

At the end of the day, CFOs want to create stability for their organizations — especially in the current uncertain economy.

Subscriptions empower CFOs to do just that by making revenue and inventory more predictable and by boosting LTV. Make these benefits clear in your pitch, and you’ll be on your way to launching a subscription product.

To learn more about Ordergroove’s subscription platform as you craft your pitch, click here to request a product demo.