Thought Leadership

What’s the total cost of ownership for your subscription solution?

Geopolitical instability. Persistent supply chain issues. A looming global recession. The number of consumers planning to spend less because of inflation hovers near the record high.

To absolutely no one’s surprise, smart eCommerce brands and retailers are examining their books to see where they can save money without disappointing customers and compromising their loyalty. The current economic climate hasn’t exactly lowered the bar — 52% of consumers expect an even better experience from their favorite brands right now, and are prepared to jump ship if they don’t get the good stuff like fast service (72%) or a personalized shopping experience (65%).

We can all agree that subscriptions are one of the best ways to deliver the convenience and reliability that customers crave. They’re also the best way to grow customer lifetime value (LTV) and offset rising customer acquisition costs. But because every technology provider and homegrown solution comes with a range of initial and ongoing expenses that add up over time, it can be hard to be 100% sure about the actual value subscriptions add to your bottom line.

This is the time to ensure you’re spending your budget wisely and forecasting ROI correctly. The first step is looking at the total cost of ownership for your subscription solution.

What’s total cost of ownership?

Total cost of ownership (TCO) is precisely what it sounds like — the total cost of a product or service over its entire lifespan, from the original purchase or build, to maintenance costs and eventual upgrades, plus operational costs like time and training required for ongoing usage.

While this is pretty straightforward to calculate for a personal purchase like a car, it gets more complex when you consider the TCO for software (like your subscription solution) that impacts not only your customers but teams across your business.

Those intricacies are exactly why you have so much to gain from a clear picture of it.

Why total cost of ownership matters for your subscriptions

Think of the TCO of your subscriptions as a defining variable in the equation for sustainable financial performance and long-term business growth. The lower your TCO, the better off you are.

A TCO analysis can help you pinpoint every direct and indirect cost associated with your subscription solution so you can more accurately understand spend and identify ways to optimize. This might include the need for a better solution that can lower costs and allow you to redistribute resources before a few small inefficiencies add up to an impossible cost.

Suffice it to say that the total cost of ownership for your subscriptions matters quite a bit to the longevity of your eCommerce business.

What impacts the TCO of your subscription experience?

When calculating the TCO for subscriptions, the most important factors to consider are how you plan to acquire or develop subscription technology, the deployment of the technology, and the ongoing maintenance and upgrades it incurs.

Acquisition and development costs

Software pricing model

Pricing plans for subscriptions come in all shapes and sizes — most charge a monthly fee for usage while also tacking on additional transaction fees for each subscription sale (and sometimes one-time sales) you make.

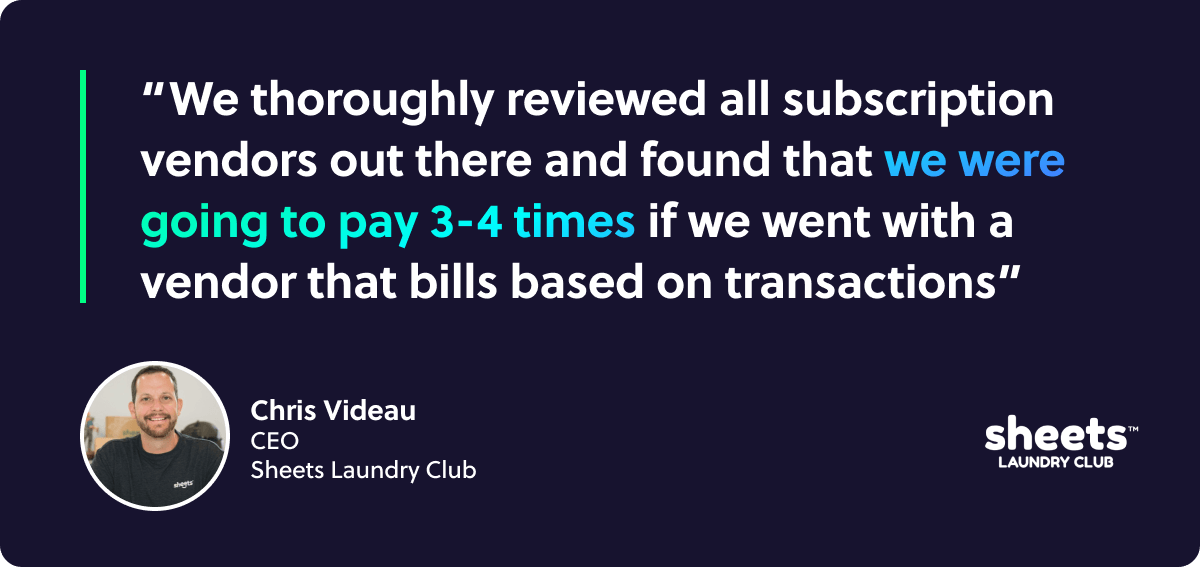

For obvious reasons, individual transaction fees can dramatically increase the TCO of your subscription platform. Brands with a low average order value and high transactional frequency need to pay special attention to this type of subscription platform. Even a few cents on every order adds up quickly.

Take Sheet’s Laundry Club, for example. When searching for a new subscription platform to migrate to, they routinely ran into solutions with transaction fees.

“We thoroughly reviewed all subscription vendors out there and found that we were going to pay 3 to 4 times if we went with a vendor that bills based on transactions,” said Sheets CEO Chris Videau in an Ordergroove webinar.

Development costs

Maybe you built your own native subscription solution to get around spending on a third-party technology or to have control over your bespoke experience. The reality is that every project, even the ones you spin up internally, comes with initial (and maintenance) costs to consider. To uncover the TCO for your homegrown solution, factor in the engineering and product resources that got it off the ground — and keep it running over time.

The average senior developer makes about $148,000 per year in 2023, which is about $71 per hour. Multiply that by how many people worked on the project and for how long. Then factor in how often your homegrown solution requires maintenance to function correctly and keep pace with new best practices and privacy standards, and — well. You do the math.

Fulfillment costs

Your subscription experience is up and running, and your customers love it. That’s fantastic, but don’t forget to check the impact more subscription sales might have on your fulfillment costs.

You’ll need to consider additional inventory storage, custom packaging, and the time impact on your warehouse team. Pay special attention to how your homegrown or third-party subscription solution handles SKUs. If the platform creates numerous subscription SKUs it will impact the efficiency of your fulfillment team drastically and potentially amplify shipping mistakes.

Technology deployment

Deployment costs

Deployment of any new software or initiative incurs a cost. The extent of the cost varies depending on the technology and your desire to customize. If you’re buying software, it’s almost always cheaper to deploy than if you build it yourself. But if you desire to create a highly sophisticated subscription experience but the platform you’ve purchased allows for little customization, you could wind up spending more than you bargained for in-house or external developers.

In either case, those expenses factor into the total cost of ownership.

Additional software needs

There’s a reason so many subscription solutions are available these days — each comes with unique functionalities to meet different eCommerce needs. If you choose a solution that meets just a few of yours, you must also acquire additional software to tailor your subscriptions to your goals. For instance, it’s common for brands to purchase software to implement advanced dunning, upselling, cart opt-ins, gifting, customer support, SMS, and churn segmentation for personalized outreach. You’ll need to include additional software purchases in your TCO.

It’s a similar story for any subscription solution built in-house. If it doesn’t tick all the boxes you need, you’ll need to pour your own dev resources into building new functionalities. The cost can add up quickly in the short and long term as your business goals evolve.

Flexibility for the future

Another tech consideration that influences TCO is how much flexibility your subscription solution affords your business today, five years from now, and 10 years into the future. A solution that slows you down instead of propels you forward in a time of rapid market change can set you up to pay an unforeseen cost when the stakes are highest.

A good indicator of future flexibility is how well your subscription solution integrates with the rest of your tech stack and other leading platforms and APIs for online brands and retailers. If it’s well-established within the broader eCommerce ecosystem, you can be confident it’s flexible enough to grow with you instead of costing you when new market trends emerge. A flexible subscription platform will also have a history of innovation and a product roadmap that shows they are developing solutions for emerging marketing challenges.

Maintenance and upgrades

Customer support bandwidth

Some subscription solutions offer a better user experience to the end customer than others. If customers find it challenging to pause or skip a month of their subscription, swap out a product, or cancel it altogether, there are more potential costs on the horizon than the risk of losing a customer.

If your subscription experience creates friction with customers, you can count on an influx of service tickets that take bandwidth from internal resources. Those constraints must be quantified and accounted for in the total cost of ownership for your subscriptions.

SKU management

Whether you use the same inventory to serve multiple sales channels — or use a subscription solution that requires multiple SKUs for subscription products — the risk of fulfillment issues and duplicative work increases with each layer of SKU complexity.

If SKU management is a headache with your subscription solution, it will add up in your operational costs: More time spent setting up promotions and discounts for duplicate SKUs, slower fulfillment, errors and returns, and even lost sales from accidental stockouts are all potential add-ons to the TCO for your subscriptions.

Knowledge and time

Last but not least, you’ll need to account for the time it takes to learn your subscription software and the best practices to optimize your experience. However, you can lower the time it takes to get started by partnering with a subscription platform that powers innovative experiences like Shinesty and offers a dedicated customer success team. These solutions will help you rapidly gain expertise you wouldn’t game with a bare-bones platform or a homegrown solution.

The more you know about subscription TCO, the more you grow.

Meeting customer expectations. Stopping churn before it starts. Predictable revenue during turbulent times. The benefits make it easy to call subscriptions the antidote to uncertainty in the eCommerce landscape — and overlook the indirect costs that eat into your bottom line. At the end of the day, recurring revenue and increased LTV are worth far less if the subscription experience you use to get there drains money and other resources along the way.

Want to learn more about subscriptions? Our case studies have all the answers about how Ordergroove helps leading brands like L’Oréal, Dollar Shave Club, OLLY, and La Colombe Coffee transform one-time purchases into relationships that can weather market uncertainty and any other storm this year throws at us.