Thought Leadership

Customer acquisition cost vs. lifetime value: How to calculate them and why they matter

How can you determine your ideal marketing spend? More importantly, how can you determine your ideal business spend to attract and retain the highest possible number of new customers while remaining profitable?

For an eCommerce business, customer acquisition cost (CAC) and customer lifetime value (CLV) are the two most important metrics for answering these questions. One matters slightly more than the other (we’ll get to that below), but both play a major role in helping you analyze and improve the success of your business.

In this post, we’ll cover the basics of both CAC and CLV and why they matter to online merchants. We’ll elaborate on the relationship between the two metrics and explain how merchants can succeed in competitive markets by optimizing their CLV to CAC ratio. Let’s dig in.

Blog: Is a subscription-based business model right for your business?

What is customer acquisition cost?

Customer acquisition cost describes the total direct and indirect cost of converting a member of your target audience into a paying customer.

For online merchants, these costs can vary widely. CAC includes not only the price of related marketing campaigns but also the storing and shipping of the actual product, as well as the costs of any marketing or sales professionals who have worked to procure the customer.

In other words, this is a business-level metric. A lower customer acquisition cost naturally leads to greater profitability potential, making this an important KPI across the entire business.

Why knowing your CAC matters

As a business-level metric, CAC tends to be an easy check for sustainable revenue and success in eCommerce.

Put simply, your average CAC needs to be below your average order value (AOV) to turn a profit. If your CAC trends above your AOV, lower it by focusing your marketing efforts on reducing customer churn.

CAC can also be an effective measure of a competitive environment — and sometimes a barometer for industry-wide challenges. A 2022 study from SimplicityDX found that customer acquisition costs have risen 222% in the last eight years due to compounding factors that affect almost every brand, like the introduction of iOS 14.5, the decline of third-party cookies, and legislation like GDPR.

How to calculate CAC

You can measure your CAC with this simple formula:

CAC = (Total Cost of Sales and Marketing) / (Number of Customers Acquired)

Total costs of sales and marketing can include:

- The salary or contract cost of anyone involved in your marketing effort. If they work in marketing part-time, only calculate their salary using that same fraction.

- Any overhead such as equipment or office space.

- Any tools, from an online store or payment processing system to your email marketing software, that are needed to acquire new customers.

- All direct advertising costs for channels like Google, social media, programmatic displays, etc.

- All costs that are required to get your product into the hands of your customers once you’ve converted them, including packing, shipping, and handling.

As an example, if a company spends $1,000 in a year to acquire 20 customers, its CAC would be $50.

When using CAC to make business decisions, remember that consistency is key. Your CAC calculation only yields reliable insights over time if you include the same types of costs each time you benchmark your efforts.

What is customer lifetime value?

The lifetime value of a customer describes the total amount of revenue an existing customer will deliver over their typical lifespan.

For instance, imagine that the average customer stays with your company for about two years and makes five purchases from your website, each worth an average of $50. Your CLV, in this case, would be $250.

Why knowing your CLV matters

CLV matters when selling goods online because it presents a holistic view of your customer base’s revenue potential. Rather than focusing on first-buy metrics like AOV, you get a true idea of just how much each customer you acquire will be worth over their lifespan.

As a result, you can use this metric not just to determine the success and efficiency of your marketing spend but also to shift your emphasis from customer acquisition to increasing customer loyalty. The AOV for the first conversion matters little if the major purchase comes once a customer has already tried out your products.

Not to mention, those repeat customers are 6 to 7 times cheaper to sell to, and spend up to 67% more per purchase.

How to calculate CLV

There are many ways to calculate CLV, ranging from simple to complex. Here is a common formula:

CLV = (AOV x Repeat Purchase Rate) – CAC

To calculate your AOV, divide revenue by the total number of orders in a given period. Your repeat purchase rate is the percentage of customers who purchase more than once from you in the same timeframe.

How CAC and CLV work together

One focuses on cost, while the other hits on the value side of the equation. That might give it away: CAC and CLV are at their best when closely intertwined to provide an overview of business success.

To accomplish that feat, eCommerce experts recommend focusing on a metric called CLV to CAC ratio. This metric compares the full value of a customer to the cost of acquiring that customer.

If the ratio is less than one, the company is losing revenue each time it acquires a new customer. A ratio above one suggests revenue gained but not necessarily profitability. After all, there are business costs unrelated to acquiring a customer.

Generally speaking, most merchants focus on a ratio greater than three, although that can change based on whether the merchant is in high-growth mode or maturing, the competitive environment, and other factors.

A ratio above five can suggest improvements, as well. It’s an important indicator that investing more in marketing would improve acquisition efforts and yield more online sales.

CAC and CLV: What matters more for eCommerce success?

Both CAC and CLV are vital pieces in measuring your business’ success. However, improving your CLV tends to be more crucial than lowering your CAC for a few reasons:

- CAC is at least, in part, dictated by external market conditions, your audience, and competition, and is more difficult to change. As a result, a focus on CLV can make a more tangible revenue impact.

- A higher CLV means you can spend more to acquire each customer, allowing your investments in customer acquisition to spread further and become more effective.

- CAC can be a hot-button metric because of its focus on lowering costs. Non-marketing executives may be tempted to cut your marketing expenses to lower it.

8 ways to improve your CLV to CAC ratio

Any effort to improve your CLV to CAC ratio can focus on either end of the equation. The below tactics are just a few of the many examples through which you can minimize unnecessary costs while maximizing value.

A focus on boosting your customer retention rate is key to achieving both.

1. Implement a subscription experience

In a traditional eCommerce business model, your CLV depends on customers making individual choices to buy your product every single time. A subscription model automates that process, increasing convenience for your customers and helping you build a more predictable and reliable revenue stream.

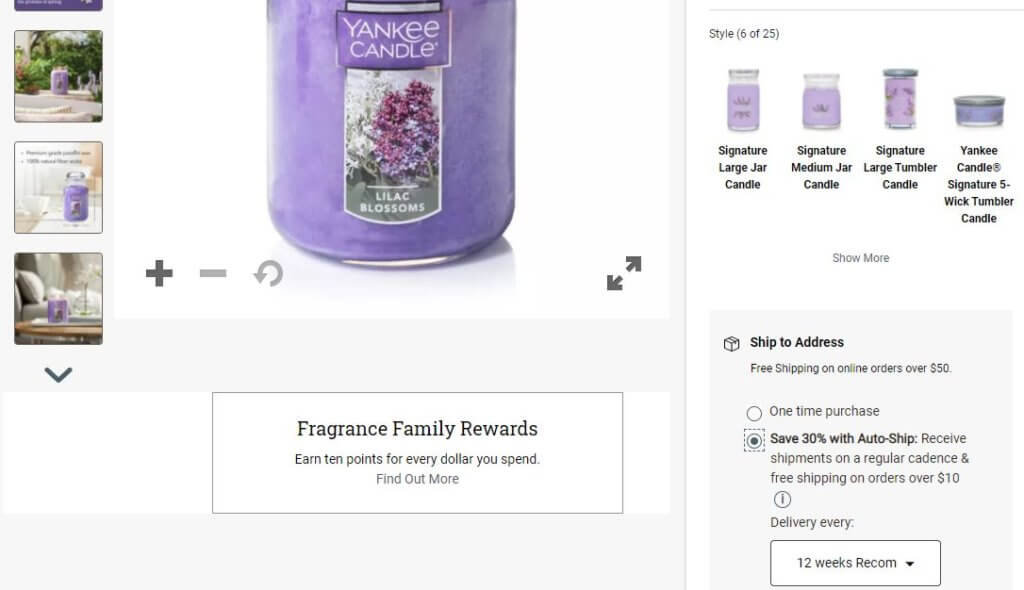

A subscription experience can co-exist with the traditional eCommerce model. But since subscriptions are a more effective way to grow CLV, it’s important to show customers the value of subscribing.

For each eligible product, Yankee Candle gives customers the option of buying it once or enrolling in a subscription plan and saving money.

Yankee Candle also makes it easy for customers to set their candle delivery cadence, an added incentive to enroll.

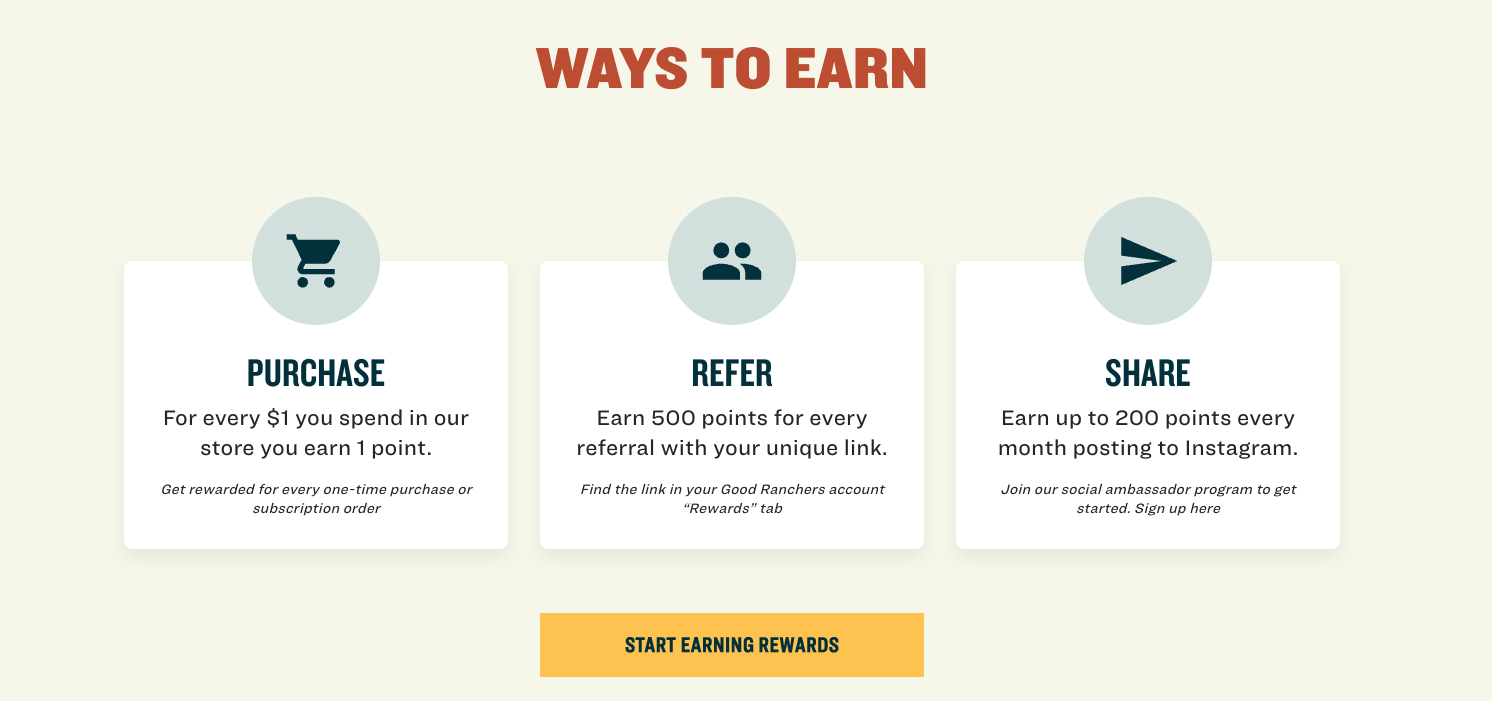

2. Create a customer loyalty program

A loyalty program incentivizes your customers to stick with you for longer. It rewards them for initial and recurring purchases through points, discounts, or other perks. That, in turn, increases your CLV without raising your CAC.

As a bonus, loyalty programs also tend to increase customer goodwill and, as their name suggests, brand loyalty.

Good Ranchers is a great example of how the right loyalty program can turn repeat customers into full fledged brand ambassadors. It all started when they decided to integrate Ordergroove with their loyalty program provider.

Their goal was to make it easy for customers to earn points and quickly hit milestones that will get them up to $70 off their next subscription box, so customers see that they’re willing to give them something back.

Tangible rewards for loyal customers, especially if the rewards are unique, increase the likelihood of future purchases while decreasing the possibility your buyers will move to a competitor.

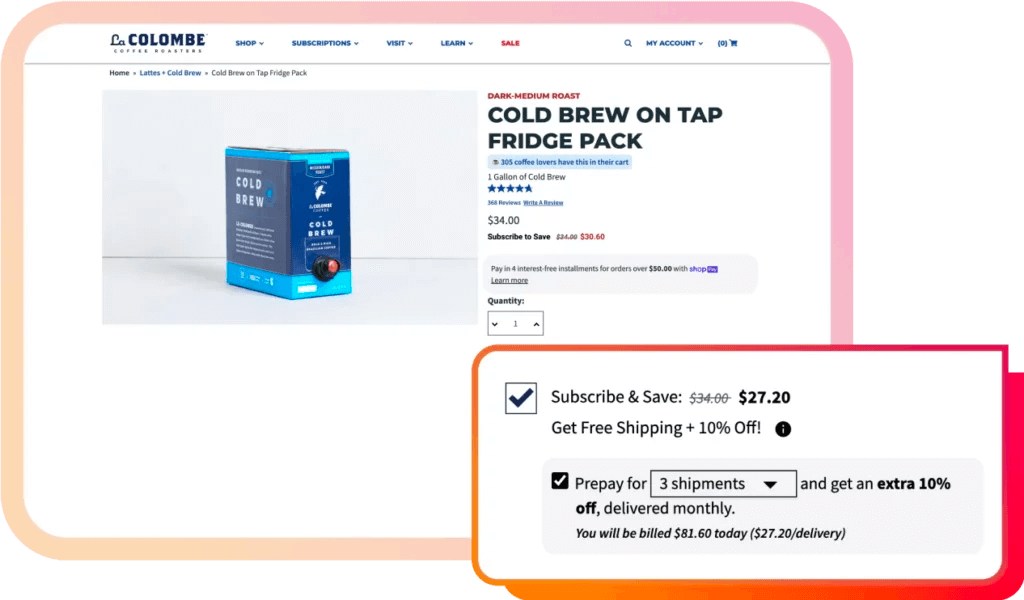

3. Offer prepaid subscriptions

With CAC jumping somewhere between 60% and 222% in the last several years and inflation rising, brands are on the hunt for ways to drive stability and extend CLV. La Colombe would be the first to tell you that prepaid subscriptions are one of the best ways to go about it.

Prepaid subscriptions allow customers to subscribe for a longer term in exchange for a steeper discount. For La Colombe’s subscribers, that looks like free shipping and 10% off for a monthly subscription, and an additional 10% off when they prepay for three shipments delivered monthly.

There are numerous advantages to prepaid subscriptions, including upfront, predictable, and repeatable revenue. Still, the most significant benefit is they can generate four times the CLV of traditional pay-as-you-go subscriptions.

Why? With prepaid subscriptions, consumers receive better savings and increased convenience compared to bulk buying (they don’t have to pick up heavy boxes and store products). Prepaid subscriptions also deliver more flexibility by offering an alternate path to subscription enrollment. In other words, prepaid subscriptions enable you to meet consumers where they are in their relationship with your brand. New subscribers can enroll in a monthly subscription, while your most loyal subscribers can enroll for longer.

Pay-as-you-go subscriptions are an excellent way to boost your CLV. But if you want even more lifetime value, prepaid subscriptions will take your subscription offering to the next level.

4. Encourage and incentivize customer referrals

Referrals can drastically lower your acquisition costs. A customer praising your product in front of their friends and family or professional network out of pure brand satisfaction is completely free. Even incentivizing them with an active referral program carries lower costs than a comprehensive advertising strategy based on demographic markers.

Referrals, of course, only work if your customers love your product and brand experience. But when they do, a strategic approach to encouraging them can have a major impact on your CAC and improve your CLV/CAC ratio.

5. Use reorder capabilities to minimize friction

What if you could dynamically encourage your customers to reorder with you when their needs are the greatest? For products that your customers use up over time, a simple text or email reminding them to reorder could go a long way.

In the process, you reduce friction. When the tool you use can identify the ideal points for reaching out — and even offer a personalized touch — spending on customer retention can be optimized. That improves your lifetime value while putting less focus on CAC.

Bonafide is a health supplement brand that migrated their subscription experience to Ordergroove to remove as much friction as possible from the buying experience.

Switching to Ordergroove made it possible for Bonafide to pilot a new functionality they call Magic Link, which dynamically ties every link in their email and SMS marketing campaigns to subscribers’ Shopify IDs.

That means whenever subscribers click through on marketing outreach, they’re automatically logged into their subscription account as soon as they land onsite. From there, they can add items to their next subscription order. No checkout necessary.

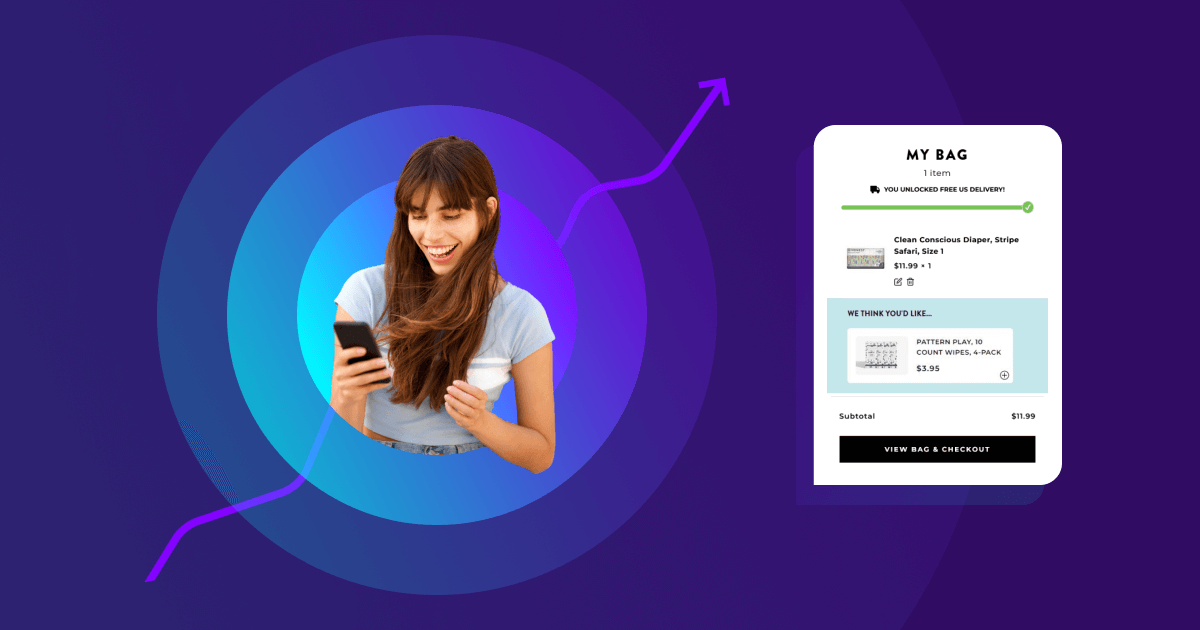

6. Upsell and cross-sell based on search and order history

One of the best ways to improve the CLV side of the equation is to upsell and cross-sell using information you’ve gathered about the customer. These tactics help increase AOV, which, in turn, leads to a higher CLV.

Loyal customers have an order history, which helps you recommend more expensive products – if they’re gradually trading up – or products that complement recent or frequent purchases. For new customers, upsell and cross-sell based on browsing behavior.

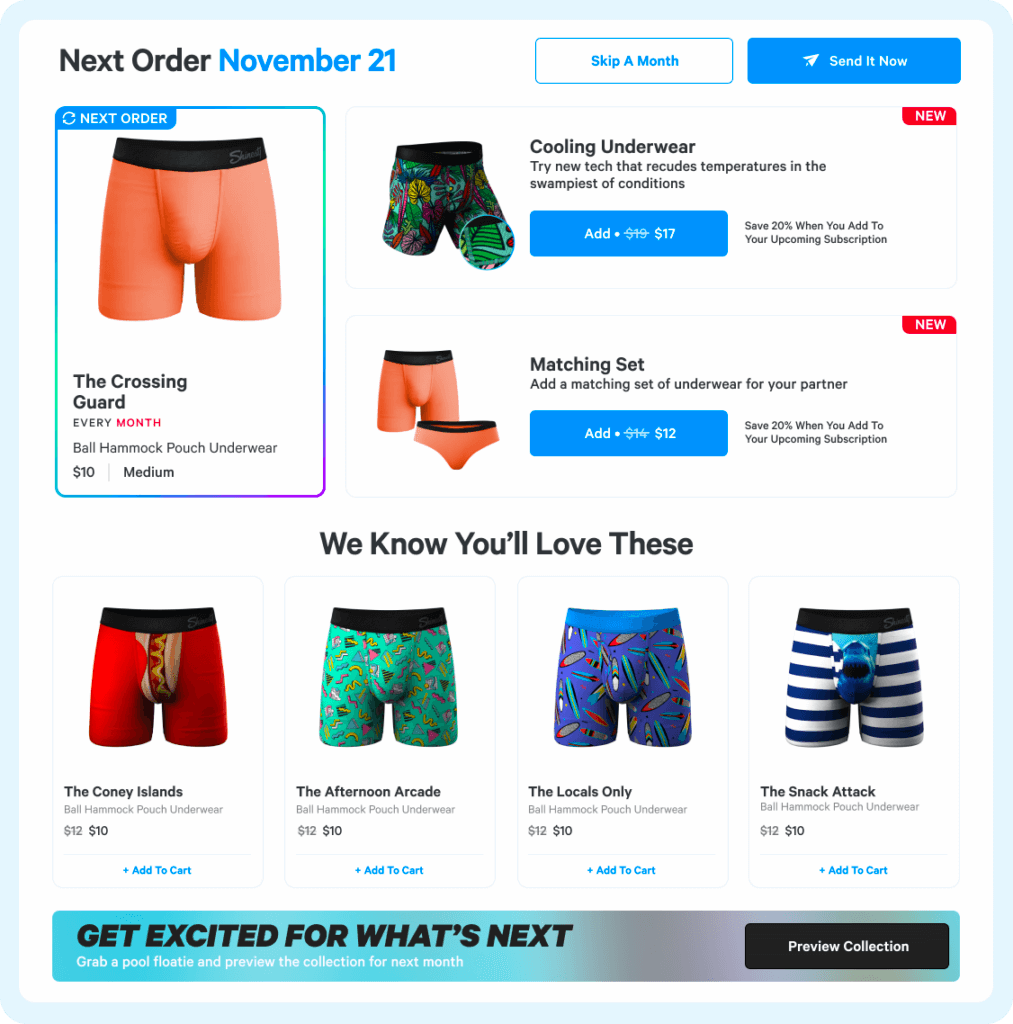

For an example of a brand getting creative with personalized upsell and cross-sell offers, look no further than Shinesty. On top of offering one of the most customizable underwear subscriptions on the market — which tracks subscribers’ order histories to ensure no pair of underwear is received twice — they also offer upsell and cross-sell deals so subscribers can save more money by adding items to upcoming orders.

Putting those offers on a silver platter led subscribers to quickly snap up the deals — and led Shinesty to an immediate 5% increase in revenue after launching upsells.

7. Optimize paid ads for customer acquisition

Paid-ad competition and changes to privacy data, whether search or social, is causing the cost of acquisition to soar. Without frequent ad audits, these costs can quickly shrink your profit margins.

According to 2023 benchmarks from LocaliQ, the average Google Ads cost per click is $4.22 and the average cost per lead is now 20% higher year-on-year at $53.52. And it’s been a similar story for paid social over the last few years — social media made up 33% of all digital ad spend in 2022, reaching $134 billion spent annually for 17% increase year-on-year.

To keep these costs in check, it’s critical to A/B test frequently to assess which ads resonate most with customers.

Google allows you to rotate search ad headlines and descriptions until it finds the combination that converts best. You can even test when ads appear, tailoring your spend to when ads are most likely to convert.

For social media ads, visuals are enormously important as you only have a moment to grab customers’ attention while they scroll. A/B test photos and short video clips and see which yield the most clicks.

8. Set a free shipping threshold

Like cross-selling and upselling, a free shipping threshold increases AOV. It encourages customers to fill their shopping carts until they hit a dollar amount that qualifies them for free shipping. According to internal research, a free shipping threshold can increase AOV by as much as 27%.

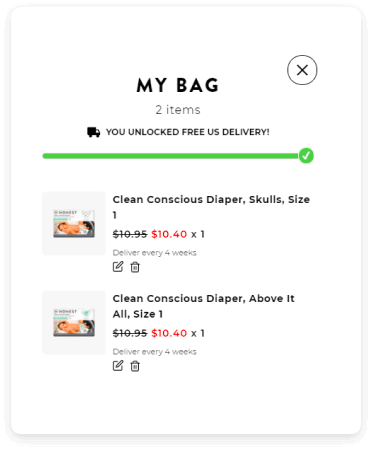

The Honest Company gamifies their $20 free shipping threshold by presenting it as a prize to be won.

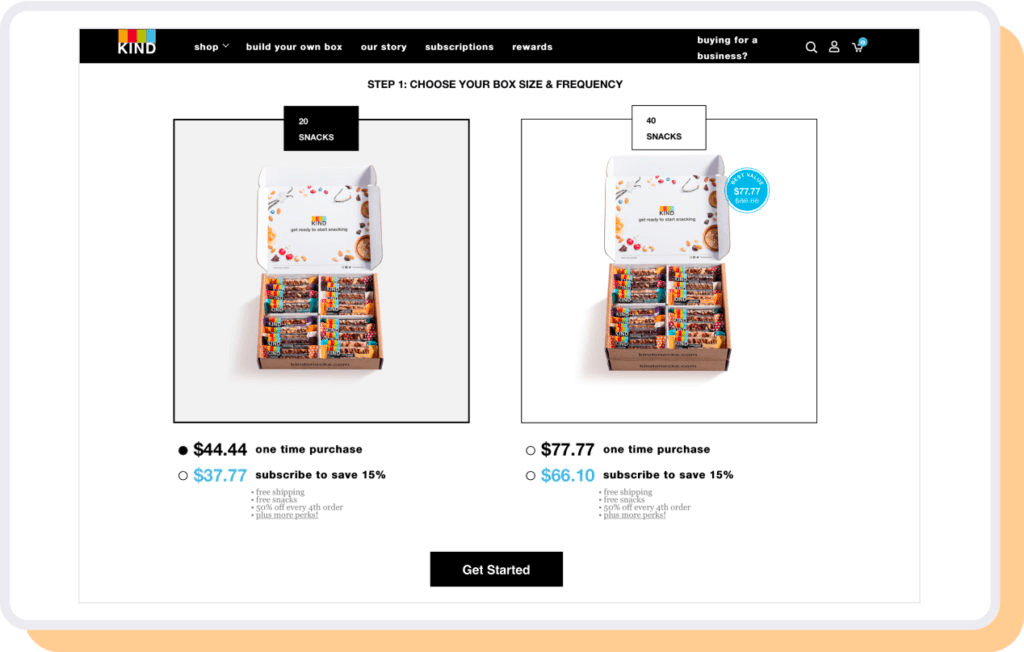

KIND Snacks, on the other hand, incentivizes subscribers to enroll with free shipping — and 15% off — for all subscription orders.

No matter the specifics of the shipping threshold, it’s always best to call out the benefit and value to the customer right on the product page — and wherever they have a chance to take actions like add to cart or complete the purchase.

Build customer relationships to improve CAC:CLV ratio

If your customer acquisition costs exceed your average order values, reduce the need to acquire customers by working harder to keep the ones you already have.

Customer retention is impossible without focusing your marketing efforts on growing customer relationships. Subscription experiences, loyalty programs, and personalized offers and communications all contribute to making the customer feel connected to your brand.

Join the leading brands making it all look easy with Ordergroove.

What to know more about subscriptions?

Check out our nine-part guide. It contains everything you need to know to launch and optimize your subscription experience.