Win the holiday long game: Retain discount shoppers beyond after BFCM with relationship commerce

With a record 200 million consumers shopping during Black Friday Cyber Monday (BFCM) in 2023, the average consumer expected to spend around $902 on holiday gifts and necessities this year. This high-propensity shopping period is a golden opportunity for merchants to set a new high watermark for sales, and make recurring revenue the gift that keeps on giving with a BFCM subscription strategy.

But what we’ve found from analyzing a range of retailers and industry trends is that promotional tactics like deep holiday discounts tend to attract one-time bargain shoppers who rarely go on to make another purchase. Lower lifetime value (LTV) from one-time shoppers, combined with discounting, can severely impact a brand’s unit economics, leading to money lost on a per-customer basis, even with increased sales.

In this article, we’ll cover everything brands and retailers need to know about the unit economics of discounting so they can grow profitably and win the holiday long game.

Spoiler: it’s all about retaining bargain shoppers well after the BFCM dust has settled to maximize profits and LTV — and there’s nothing quite like subscriptions when it comes to engaging customers long enough to improve the unit economics of discounting.

But before we dive in, how do brands wind up offering holiday discounts that cost them more than they’re worth in the first place?

The flawed unit economics of BFCM discounts

It’s common sense that a shopper who waits all year to take advantage of holiday sales will be quicker to churn, place fewer lifetime orders, and yield less LTV. This matters because LTV is what makes or breaks a brand’s unit economics, and how much money they actually make off of each customer.

To illustrate how different types of discounts can impact a brand’s bottom line, let’s consider some examples.

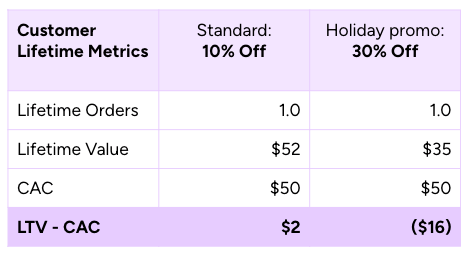

In the first scenario, the brand offers a 10% off year-round discount. The average customer is expected to place a single lifetime order, and the cost of acquiring that customer (CAC) is $50. The total LTV minus CAC is $2 in this case, meaning the brand does a little better than breaking even with that discount offer on a unit economics basis.

But if that same brand offers a higher holiday promotional discount of 30% off — and the average customer still only places one lifetime order, and still costs $50 to acquire — then their LTV minus CAC works out to -$16, meaning that their 30% off holiday discount is actually costing the brand money on every customer.

The holidays are already a high-stakes time for brands when it comes to competition and acquisition costs. Despite good intentions like trying to meet consumer expectations for holiday deals or hit revenue numbers at any cost, BFCM discounts can inadvertently reward the wrong customers and quickly become a race to the bottom for merchants.

In other words, the costs of BFCM discounts outweigh the benefits if merchants can’t retain those customers to grow LTV and offset CAC.

Retention and LTV: The key to profitable holiday discounts

The answer isn’t to avoid discounts altogether during the holiday shopping rush. However, brands need to pull any levers they can to improve their unit economics and make sure their business grows profitably throughout the holidays and beyond.

On that front, retention is a critical piece of the puzzle. The more lifetime orders the average customer places, the more LTV brands have to justify customer acquisition costs.

But how can brands retain customers and encourage repeat purchases among the discount shoppers who flock to them during BFCM?

One good way is through subscriptions, which are known to drive better retention and improve the unit economics of generous discounting. To illustrate, we’ll compare two examples.

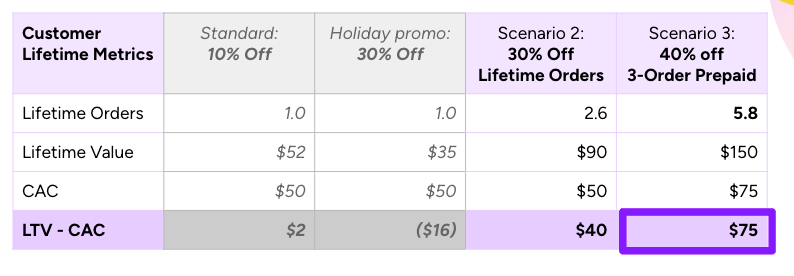

In the first scenario, the brand offers the same 30% off discount — but for all lifetime subscription orders instead of just the initial purchase — with the average subscriber who signs up during BFCM expected to place 2.6 lifetime orders. Their LTV minus CAC works out to $40 in this case, and the immediate improvement to the unit economics of their 30% discount is thanks to getting more lifetime orders from subscribers.

In the second scenario, the brand decides to tap into the power of prepaid subscriptions to guarantee month-over-month retention and boost LTV with a 40% discount offer on three prepaid orders. Because prepaid subscriptions are designed to engage subscribers for longer periods of time, we can assume an average of 5.8 lifetime orders and that the total CAC for this valuable segment is $75.

The higher order retention rates in scenario two with prepaid subscriptions yield enough LTV to cover the higher discount and acquisition costs, unlocking the most favorable unit economics so far with an LTV minus CAC of $75.

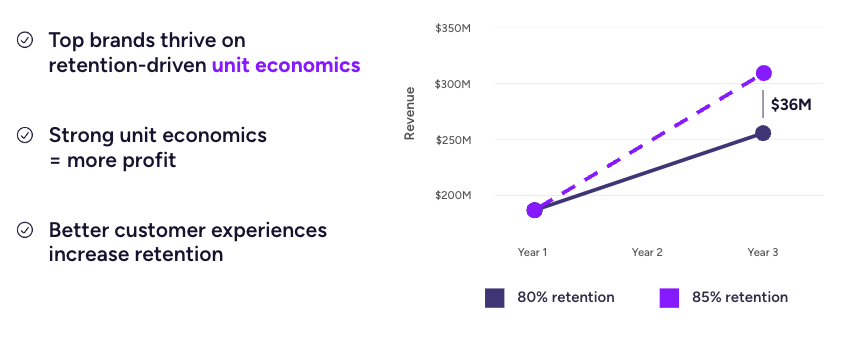

The takeaway is that retention-driven unit economics are highly valuable year-round, and especially during the holiday shopping rush when heavy discounting is a common practice.

3 Tactics to retain and grow LTV from holiday subscribers who came for the discounts

Considering that even a small difference in retention can have a meaningful impact on revenue in both the short and long term, the brands who come out on top of the holiday long game will be the ones who use peak shopping season to establish retention-driven unit economics to drive profitable growth well beyond BFCM.

That means ensuring subscribers who enrolled during the holidays stick around for far more than one lifetime order.

And besides great products, there’s nothing quite like a great experience to make subscribers stick around. Here are three tactics merchants can use to retain and grow LTV from holiday subscribers who came for the discounts:

1. Offer frictionless and flexible subscription management

When it comes to subscription management, many brands and retailers worry that making it easy to pause or cancel recurring orders will encourage subscribers to take their business elsewhere. The reality is that easy cancellation makes for happier customers who tend to stick around 135% longer.

But the ability to skip or pause matters just as much, with consumer research from McKinsey revealing that 14-19% of subscription cancellations can be attributed to a lack of flexibility and control over orders.

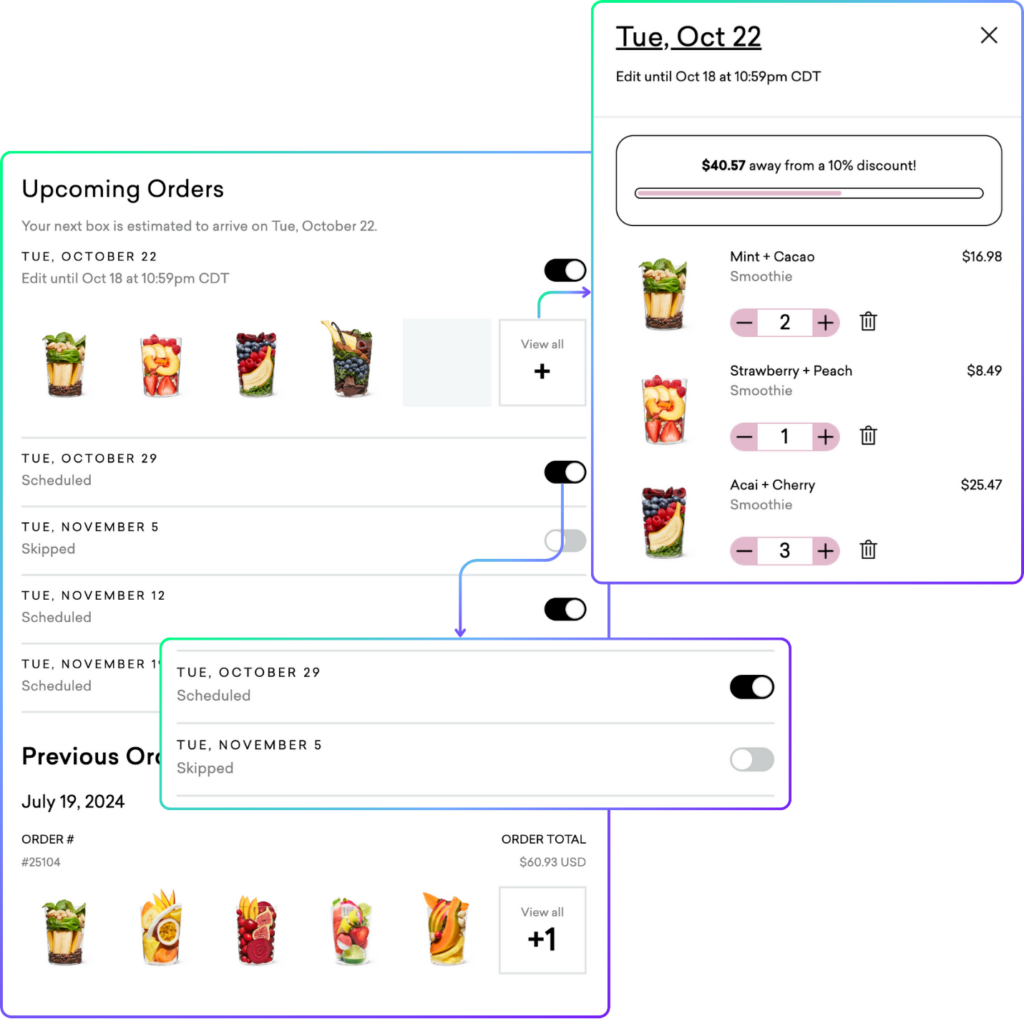

A great subscription management experience is an important piece of retention throughout the year, but it’s especially critical for retaining subscribers who enrolled during the holiday shopping rush — and who may be entirely new to your brand, or might not be your typical shoppers.

Emphasizing flexibility around delivery dates, payment options, and order frequencies increases the likelihood that subscribers will take advantage of their options, and adjust their subscription to work for them instead of canceling altogether. So, brands should take every opportunity to educate new holiday subscribers on the options they have at their fingertips when it comes to managing their subscriptions.

2. Make it easy to swap products and add to orders

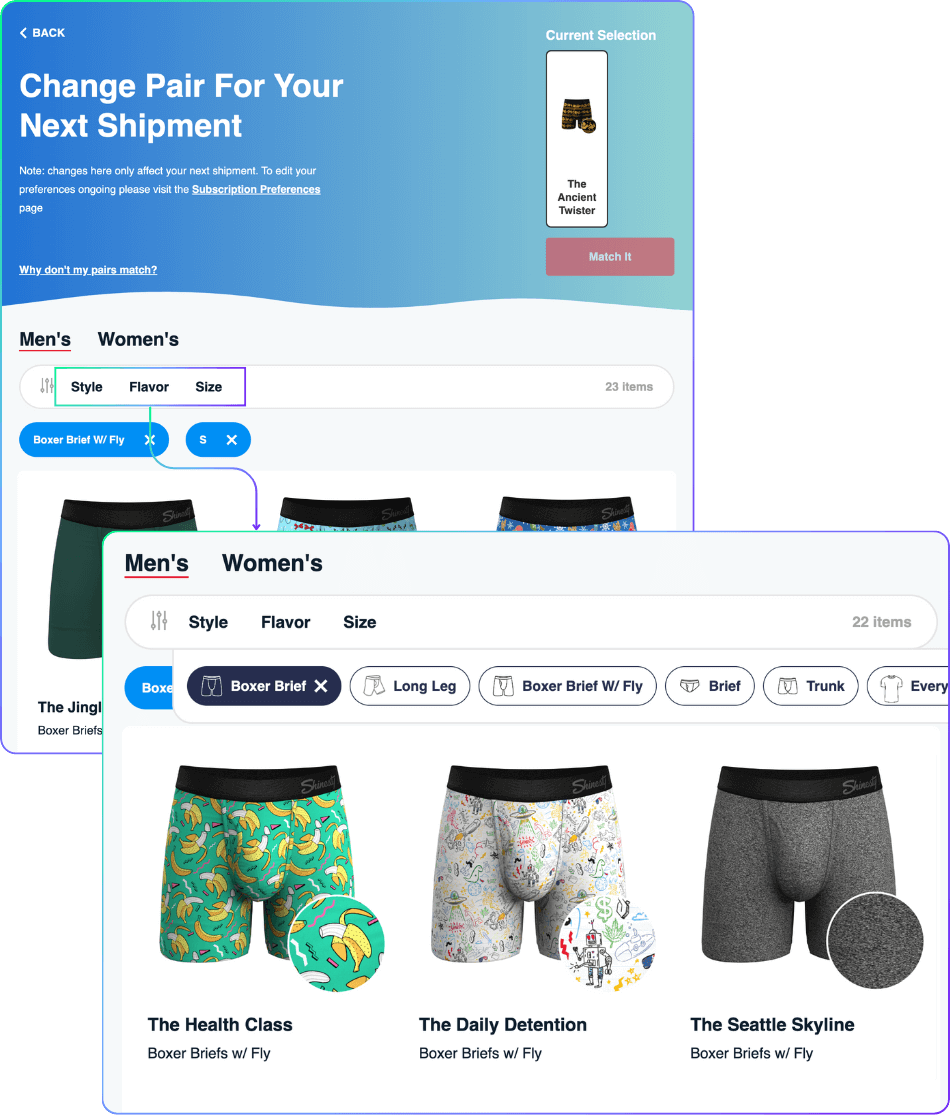

No matter the time of year, 6% of subscription cancellations can be attributed to the inability to swap products. Whether the subscribers you acquire during BFCM are first-time shoppers with your brand — or even received your subscription as a gift — there are plenty of reasons they may eventually want to try a new flavor, scent, or formula. And without the option to easily swap products, they might give up on their subscription entirely.

Empowering subscribers to easily try out new products and add new items to their order not only helps prevent this frustration, but creates an opportunity to cross-sell items for higher average order value and overall revenue.

To drive peak retention, it’s best to remind subscribers that they can swap and add on new products right where they manage their orders — including in upcoming order reminders like Ordergroove merchant Shinesty does in their emails.

3. Prevent churn with a persuasive cancel flow

Finally, some subscription cancellations are inevitable no matter what tactics a brand employs.

The good news is that a positive cancellation experience can enhance subscriber sentiment about your brand, and make it more likely they’ll buy from you in the future even if they do decide to churn.

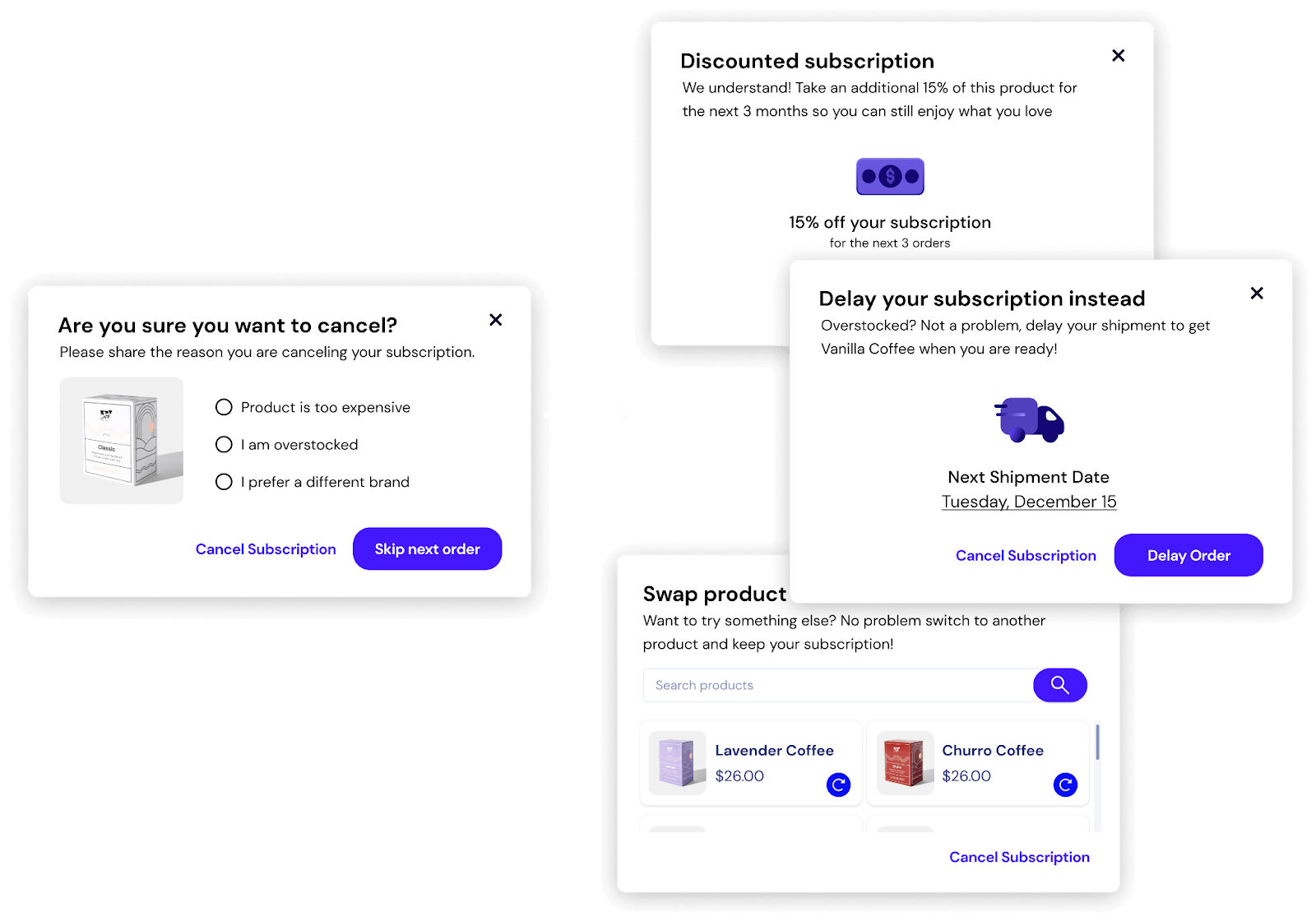

The key is making it easy but unappealing to cancel. One way to do this is by offering alternatives to cancellation, like reminding subscribers that they can skip or delay an order, or even switch to a different product instead of canceling altogether.

Another approach is to emphasize the value of the subscription by highlighting the benefits they’re giving up—like exclusive discounts or free shipping—to create some healthy FOMO around subscriber perks.

Cancel flows are most effective at stopping churn when they address subscribers’ reasons for moving on. For example, if they’re canceling due to price, a one-time discount might keep them enrolled — and for those looking to try other items, prompting them to swap products in their next order is likely to prevent cancellation.

Collecting and responding to these specific cancellation reasons not only drives better retention, but can show brands exactly how to improve the subscriber experience overall.

The best part is that if you leave subscribers with a good experience — even when they decide to go — they’re much more likely to come back when the timing is right. In other words, a simple and respectful cancellation process today can bring them back as a loyal subscriber tomorrow.

Winning the holiday long game each year with relationship commerce

When it comes to retaining subscribers for the long haul, the answer is embracing relationship commerce — which moves shoppers from once-and-done transactions to ongoing, frictionless relationships that drive more recurring revenue and lifetime value for profitable growth — with tactics like the ones shared in this article.

And there’s no time quite like peak shopping season and the months that follow for merchants to lean into the virtuous cycle of relationship commerce. It all starts by making your brand indispensable to the influx of holiday subscribers, which in turn drives stronger retention and LTV so you can afford to acquire more customers and keep scaling profitably.

Does your subscription technology offer the flexibility and capabilities you need to win the holiday long game with relationship commerce? Join the leading brands using Ordergroove to make BFCM the start of evergreen customer relationships with subscriptions.